Is the INJ Price Rally Sustainable? Insights on the $100M Injective Fund Launch

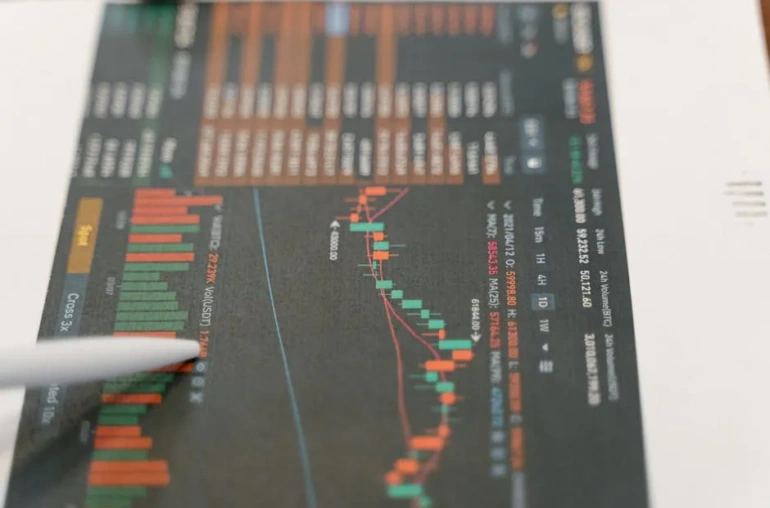

The cryptocurrency landscape is ever-changing, and the recent developments surrounding Injective (INJ) have drawn significant attention. On September 2, INJ experienced a notable price increase of 3.6%, reaching $12.90. This surge came on the heels of the launch of the $100 million Injective Digital Asset Treasury, which aims to bolster the accumulation of INJ tokens. However, while the initial response from investors has been positive, the question remains: is the INJ price rally sustainable?

The Impact of the Injective Digital Asset Treasury

The establishment of the Injective Digital Asset Treasury marks a strategic move for the Injective platform. By allocating substantial funds toward the treasury, Injective aims to not only stabilize its token but also to enhance its market presence. This initiative is designed to create a more robust ecosystem around INJ, potentially attracting new investors and retaining current ones.

Investors are understandably excited about the prospects of this fund, which signals the project’s commitment to growth and innovation. However, it’s essential to analyze the broader market conditions and the inherent volatility of cryptocurrencies before making any assumptions about the longevity of this rally.

Market Volatility and Risks

Despite the positive news surrounding the treasury launch, market volatility remains a significant concern for INJ and other cryptocurrencies. The crypto market is known for its rapid price fluctuations, and while a 3.6% increase is promising, it’s crucial to consider the potential for a downturn.

Many analysts point out that a price surge can often be followed by a correction, especially if it is not supported by strong fundamentals or increased adoption. Investors must weigh the excitement of the treasury launch against the backdrop of overall market trends and the behavior of other digital assets.

Looking Ahead: What’s Next for INJ?

As we move forward, it will be vital for Injective to demonstrate that it can maintain momentum. This involves not only effectively managing the newly launched treasury but also engaging with its community and fostering real-world use cases for the INJ token. Enhanced utility and consistent communication with investors can help build trust and confidence in the project.

Additionally, keeping an eye on broader market trends will be critical. Factors such as regulatory developments, technological advancements, and macroeconomic conditions can all play a significant role in shaping the future of cryptocurrency prices, including that of INJ.

Conclusion

The Injective Digital Asset Treasury represents a significant step toward strengthening the INJ ecosystem. While the initial market reactions are encouraging, potential investors should remain cautious and informed about the inherent risks associated with cryptocurrency investments. By staying updated on market dynamics and understanding the implications of new developments, investors can make more informed decisions regarding their involvement with INJ and the broader crypto market.