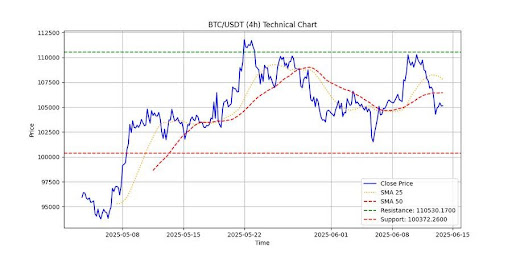

Bitcoin’s Bearish Battle: Key Levels to Watch

Bitcoin (BTC) is facing renewed pressure as it slips below critical short-term moving averages, trading around $105,148. The cryptocurrency has fallen beneath both the 25-period and 50-period Simple Moving Averages (SMAs), signaling a potential shift in momentum favoring bears. With key technical indicators flashing caution, the question on every trader’s mind is: Can bulls stage a comeback?

Why the Moving Averages Matter

Moving averages act as dynamic support and resistance levels, helping traders gauge market sentiment. The recent breakdown below the 25-period and 50-period SMAs suggests:

- Short-term weakness: The inability to hold above these levels indicates fading bullish momentum.

- Potential trend reversal: A sustained drop could signal further downside if buyers don’t step in.

- Increased selling pressure: Bears may exploit this breakdown to push prices lower.

Key Levels for Bitcoin Traders

For BTC to regain bullish footing, it must reclaim the following levels:

- $107,000: A break above this resistance could invalidate the bearish SMA crossover.

- $105,000 (current support): Holding here is critical to prevent a deeper correction.

- $102,000: A fall below this level may trigger accelerated selling.

What’s Next for Bitcoin?

While the short-term outlook appears bearish, Bitcoin has a history of defying expectations. Factors that could reignite bullish momentum include:

- Institutional buying: Large investors accumulating at lower prices.

- Macroeconomic shifts: Favorable Fed policy or ETF inflows.

- On-chain strength: Long-term holders refusing to sell.

The bottom line: Bitcoin is at a crossroads. Traders should watch the $105K level closely—holding it could set the stage for a rebound, while a breakdown may lead to further downside. Stay nimble and monitor volume trends for confirmation.