Bitcoin’s Ascent to $120K: Analyzing Market Trends and Altcoin Predictions

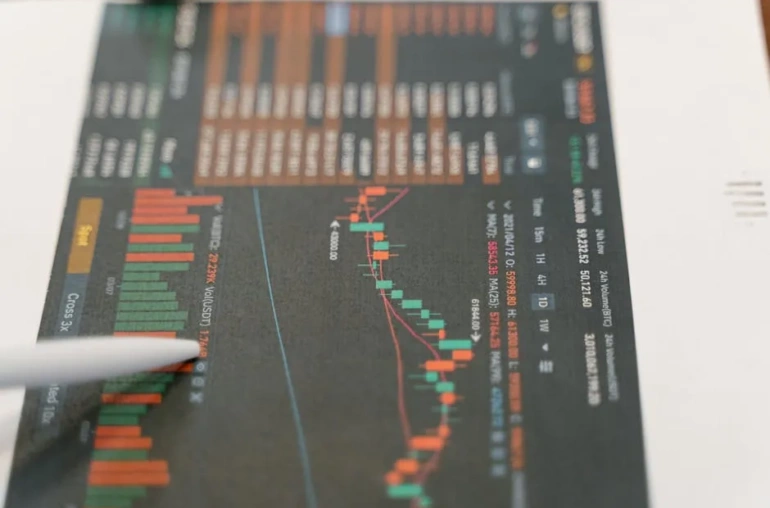

As the cryptocurrency landscape continues to evolve, Bitcoin (BTC) maintains its position as a dominant force, holding steady above 63% in market dominance. With increasing institutional interest and innovative yield strategies, Bitcoin seems poised for significant long-term growth. Recent forecasts suggest that Bitcoin could potentially reach the $120,000 mark. But what factors are driving this momentum, and how do altcoins fit into the current market narrative?

Institutional Interest Fuels Bitcoin’s Growth

The surge in institutional investment has been a game-changer for Bitcoin. Financial giants are increasingly recognizing the potential of cryptocurrencies as viable investment vehicles. This influx of institutional capital not only enhances Bitcoin’s credibility but also stabilizes its price, making it an attractive option for both seasoned investors and newcomers alike.

Moreover, various yield strategies are emerging, allowing investors to earn passive income on their Bitcoin holdings. Platforms offering staking and lending options are gaining traction, thereby providing additional incentives for holding Bitcoin in a portfolio. As more institutions adopt these strategies, Bitcoin’s position in the financial ecosystem is solidifying.

Predictions for Altcoins

While Bitcoin remains the frontrunner, the altcoin market is also drawing considerable attention. Investors are keen to explore altcoins that show promise for substantial returns. Some analysts predict that specific altcoins could see remarkable growth, with the potential for 100x returns in the coming months. This speculation is driven by the increasing adoption of blockchain technology across various industries and the continual development of decentralized finance (DeFi) applications.

Investors looking to diversify their portfolios may want to pay close attention to altcoins that demonstrate strong fundamentals and innovative use cases. As the market matures, these cryptocurrencies could play a crucial role in shaping the future of finance.

The Next 100x Memecoin: What to Watch

Amidst the altcoin frenzy, memecoins have captured the imagination of many investors. While often considered speculative, certain memecoins have demonstrated the ability to generate substantial returns, leading to the question: which memecoin could be the next to skyrocket?

Investors should look for memecoins that not only have strong community backing but also a unique value proposition. As the market continues to evolve, the next 100x memecoin might emerge from unexpected corners, fueled by viral trends and community engagement.

Conclusion

As we move further into 2023, Bitcoin’s trajectory appears promising as it gears up for a potential leap to $120K. The growing institutional interest combined with innovative yield strategies is creating a robust environment for Bitcoin and its altcoin counterparts. While Bitcoin remains a critical player, the altcoin market offers intriguing opportunities that investors should not overlook. Keeping an eye on emerging trends and community-driven projects can help investors navigate this dynamic landscape effectively.

Stay tuned for more insights as we continue to explore the ever-changing world of cryptocurrency.