Wall Street Gains Momentum: S&P 500 Rises Ahead of Fed Meeting and Job Reports

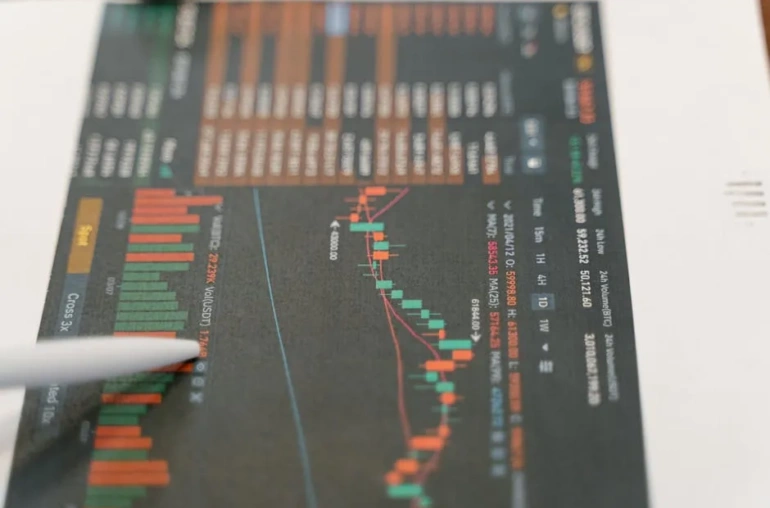

On Tuesday, the stock market showed a positive trend, with major indices inching higher as investors reacted to a series of encouraging earnings reports. The S&P 500 and Nasdaq both opened on a strong note, setting the stage for what promises to be a pivotal week in the financial landscape.

Optimism in Earnings Reports

The upbeat performance in the stock market can largely be attributed to better-than-expected earnings results from several key companies. These positive reports have bolstered investor confidence, suggesting that many businesses are navigating the ongoing economic challenges more effectively than anticipated. As a result, market participants are feeling cautiously optimistic ahead of crucial economic indicators and policy decisions.

Awaiting the Federal Reserve’s Decision

Adding to the market’s buoyancy is the upcoming Federal Reserve meeting. Investors are closely watching for signals from the Fed regarding future interest rate policies. With inflation concerns still prevalent, the decisions made during this meeting could have significant implications for market performance in the coming months.

Job Data on the Horizon

In addition to the Fed meeting, market watchers are also bracing for the release of key jobs data later this week. The job market has been a critical focus for economists and policymakers alike, as it provides insights into the overall health of the economy. Strong job numbers could reinforce the Fed’s position on maintaining or adjusting interest rates, while weaker data might lead to a reassessment of current monetary policies.

Impending Tariffs Deadline

Furthermore, investors are keeping a close eye on an approaching deadline regarding tariffs. The potential for new tariffs or changes to existing ones could create additional volatility in the markets. As businesses and consumers alike await clarity on this front, uncertainty may continue to influence trading decisions.

Conclusion

As the week unfolds, the combination of positive earnings reports, the Federal Reserve meeting, job data releases, and tariff considerations will likely shape market dynamics. Investors are advised to stay informed and ready to adapt to the rapidly changing landscape. With so many moving parts, understanding these elements will be crucial for navigating potential market shifts in the near future.