Understanding the Recent Downturn: Is the Crypto Bull Run Coming to an End?

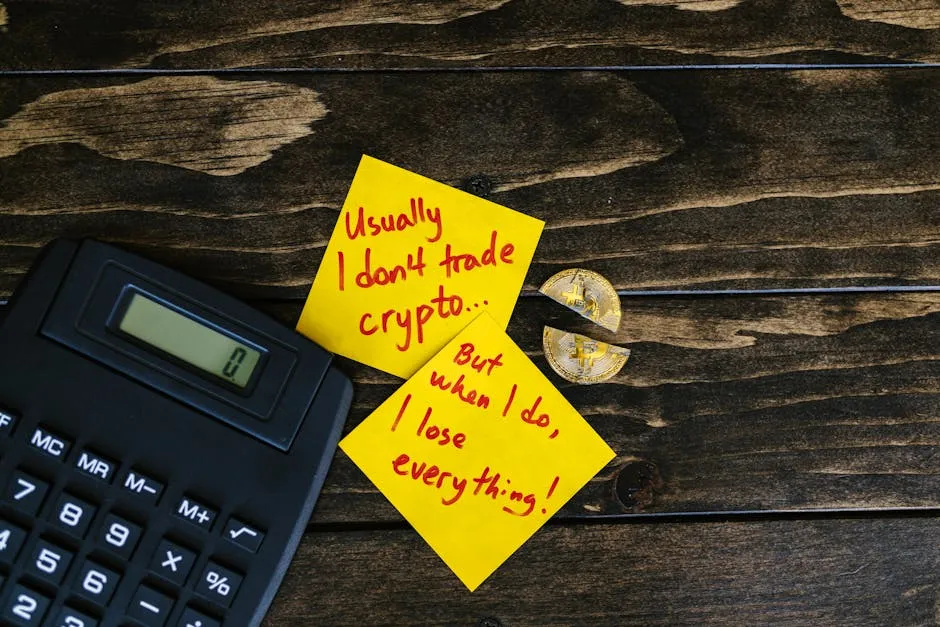

In the ever-changing landscape of cryptocurrency, recent market movements have left many investors questioning whether the much-anticipated bull run is truly over. On Tuesday, Bitcoin (BTC) experienced a significant drop, plummeting from a high of $123,200 to around $116,600. This decline has not only affected Bitcoin but has also seen most altcoins follow suit, raising concerns among traders and enthusiasts alike.

The Current State of the Crypto Market

The broader cryptocurrency market capitalization has also taken a hit, declining by over $X billion, which has intensified the discussions surrounding the sustainability of the recent bull run. These fluctuations in value are not uncommon in the crypto space, characterized by rapid increases and sharp declines. However, the current situation has prompted many to analyze the underlying factors contributing to this downturn.

Factors Influencing the Downturn

- Market Sentiment: As the prices of major cryptocurrencies drop, investor sentiment can quickly shift from optimism to fear. Many traders may opt to take profits or cut losses, further exacerbating the decline.

- Regulatory Concerns: With governments worldwide tightening regulations around cryptocurrencies, uncertainty can lead to decreased investor confidence. The potential for stricter oversight can make many risk-averse, leading to pullbacks in market activity.

- Technical Corrections: After a significant rally, it’s not uncommon for markets to undergo corrections. The recent gains experienced by Bitcoin and altcoins may have created a scenario where a correction was inevitable.

- Global Economic Influences: Broader economic factors, such as inflation rates, interest rate changes, and geopolitical tensions, can also impact investor behavior in the crypto markets.

What Does This Mean for Investors?

For investors, this downturn presents both challenges and opportunities. While it may be tempting to panic and sell during a price drop, it’s essential to maintain a long-term perspective. Historical trends in the cryptocurrency market indicate that downturns often precede recoveries. Many seasoned investors advise viewing these fluctuations as part of the broader investment journey rather than a definitive end to a bull market.

Looking Ahead

As we navigate through this period of uncertainty, it’s crucial for investors to stay informed and adapt their strategies accordingly. Monitoring market trends, understanding the factors at play, and maintaining a diversified portfolio can help mitigate risks associated with volatility. Furthermore, engaging with the crypto community and accessing reliable market analysis can provide valuable insights for making informed decisions.

In conclusion, while the current downturn has raised questions about the future of the crypto bull run, history shows that the market is cyclical. Remaining vigilant and proactive in your investment strategy will be key as the market continues to evolve.