Solana’s $5B Bet: A Game-Changer for Crypto?

In a bold move that’s sending shockwaves through the cryptocurrency world, DeFi Development Corp. (DFDV) has secured a staggering $5 billion equity line of credit with RK Capital—with plans to pour every dollar into Solana ($SOL). This unprecedented investment comes as Solana’s first Layer-2 solution nears a $50 million valuation, signaling a major shift in institutional crypto strategies.

Why Solana? Breaking Down the $5B Strategy

According to DFDV CEO Joseph Onorati, the decision to go all-in on Solana stems from three key factors:

- Layer-2 momentum: Solana’s scaling solutions are gaining traction faster than Ethereum’s did in 2021

- Institutional confidence: Major players like BlackRock and Fidelity have already backed Solana-based products

- Technical advantages: Sub-second finality and low fees make SOL ideal for high-volume DeFi applications

Market Reactions and Potential Impacts

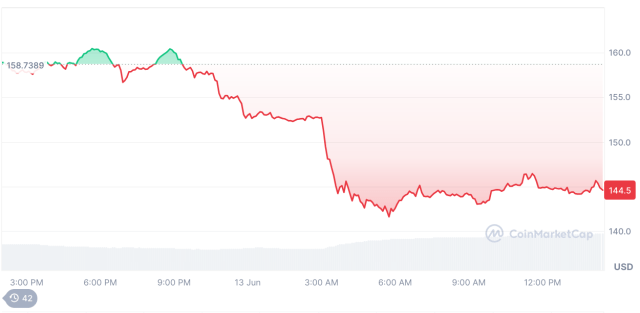

Within hours of the announcement, Solana’s price surged 18%, with trading volumes spiking to 3x their 30-day average. Analysts suggest this could trigger a domino effect:

- Increased validator participation as staking rewards become more attractive

- Accelerated development of Solana Virtual Machine (SVM) compatible projects

- Potential rebalancing of institutional crypto portfolios away from Bitcoin and Ethereum

The Layer-2 Factor

The timing aligns with the impending launch of Solana’s first major Layer-2 solution, currently code-named “Nitro.” Early testnets show:

| Metric | Performance |

|---|---|

| TPS Capacity | 12,000+ |

| Transaction Cost | $0.0002 avg. |

| Finality Time | 400ms |

This infrastructure investment could position Solana as the go-to blockchain for:

- High-frequency trading platforms

- Gaming and NFT marketplaces

- Enterprise DeFi applications

What This Means for Crypto Investors

While the $5B commitment validates Solana’s technology, experts caution:

- Volatility will likely increase as large positions are accumulated

- Regulatory scrutiny may intensify with such concentrated holdings

- The Layer-2 space could become hyper-competitive (Ethereum’s Arbitrum and Polygon already preparing counter-moves)

As the crypto market digests this news, one thing is clear: Solana is no longer just an “Ethereum alternative”—it’s becoming the centerpiece of institutional crypto strategies.