Ondo Finance Strengthens Market Position with Oasis Pro Acquisition

In a strategic move to bolster its institutional offerings, Ondo Finance (ONDO) announced on July 4, 2025, its acquisition of Oasis Pro, a broker-dealer platform regulated by the U.S. Securities and Exchange Commission (SEC). This landmark deal underscores Ondo’s commitment to bridging traditional finance with blockchain innovation while adhering to stringent regulatory standards.

Why This Acquisition Matters

The acquisition positions Ondo Finance as a leader in regulated blockchain-based financial services. Oasis Pro’s SEC compliance provides Ondo with a critical advantage: the ability to offer institutional investors a trusted gateway for tokenized assets and securities. Key benefits include:

- Regulatory Clarity: SEC oversight mitigates legal uncertainties for institutional participants.

- Expanded Product Suite: Enhanced capabilities in crypto-native securities and real-world asset (RWA) tokenization.

- Market Credibility: Strengthened trust among traditional finance players exploring blockchain solutions.

The Broader Trend: Institutional Crypto Adoption

This deal reflects a growing trend of traditional and crypto-native firms converging. Recent months have seen increased demand for regulated platforms that blend decentralized finance (DeFi) efficiencies with compliance safeguards. Analysts suggest Ondo’s move could accelerate:

- Mainstream adoption of tokenized bonds and equities.

- Hybrid financial products combining blockchain speed with regulatory transparency.

- Competition among institutional-focused crypto platforms.

What’s Next for Ondo Finance?

With Oasis Pro under its umbrella, Ondo plans to launch new SEC-compliant investment vehicles by Q4 2025. The integration aims to streamline onboarding for hedge funds, family offices, and corporate treasuries seeking exposure to digital assets. Industry watchers anticipate this could set a precedent for similar acquisitions in the sector.

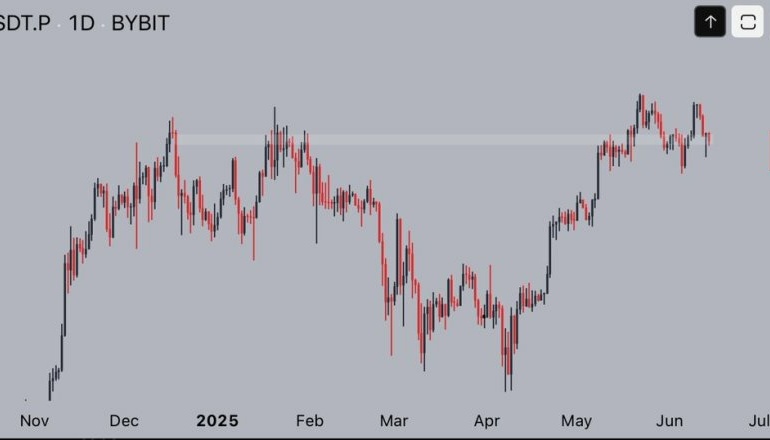

“This isn’t just about scaling—it’s about redefining institutional crypto infrastructure,” remarked an Ondo spokesperson. The company’s ONDO token surged 12% following the announcement, signaling market optimism.

Final Thoughts

As regulatory frameworks evolve, Ondo’s acquisition highlights the crypto industry’s maturation. For investors, this signals a pivotal shift: the era of compliant, institutional-grade blockchain finance is here—and it’s built on partnerships like this one.