Bitcoin’s Bullish Momentum: A Path to $168K by October?

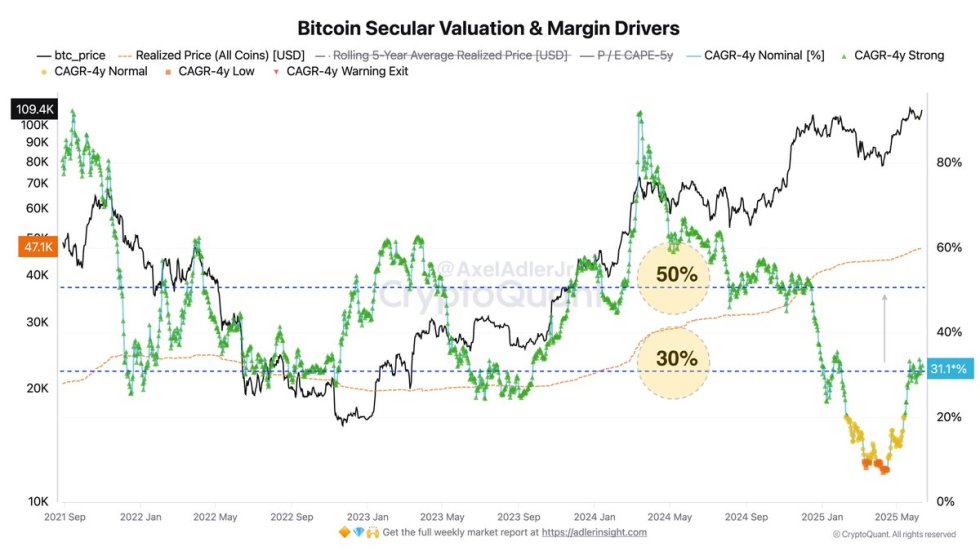

Bitcoin (BTC) is once again making headlines as its 4-year Compound Annual Growth Rate (CAGR) rebounds to an impressive 31%. With the cryptocurrency consolidating just below its all-time high of $112,000, traders and analysts are closely watching for signs of a decisive breakout. Could this momentum propel BTC to $168,000 by October? Let’s dive into the latest market trends and expert insights.

Bitcoin Holds Strong Above Key Support Levels

Despite recent volatility, Bitcoin has managed to hold above critical support levels, showcasing resilience in the face of market fluctuations. The broader crypto market is experiencing bullish momentum, yet BTC has struggled to reclaim its previous all-time high. This hesitation has left traders on edge, waiting for a clear signal of the next major move.

Analysts emphasize that a decisive breakout above the $112,000 resistance level is needed to confirm a sustained uptrend. Until then, the market remains in a consolidation phase, with both bulls and bears vying for control.

The 4-Year CAGR Rebound: What It Means for Investors

The resurgence of Bitcoin’s 4-year CAGR to 31% is a significant indicator of its long-term growth potential. This metric, which measures the average annual growth rate over a four-year period, suggests that BTC is regaining its historical upward trajectory after periods of stagnation.

Historically, Bitcoin has followed a cyclical pattern, with major price surges occurring approximately every four years. If this trend continues, the current rebound in CAGR could signal the beginning of another substantial rally.

Price Predictions: Is $168K Realistic by October?

Several market analysts are projecting ambitious price targets for Bitcoin in the coming months. The $168,000 mark by October is based on a combination of technical analysis, historical patterns, and growing institutional interest. Key factors supporting this prediction include:

- Institutional Adoption: Increased investment from major financial players like BlackRock and MicroStrategy.

- Halving Effect: The recent Bitcoin halving has historically preceded significant price increases.

- Macroeconomic Factors: Inflation concerns and a weakening U.S. dollar are driving demand for alternative assets like Bitcoin.

What Traders Should Watch For

While the outlook appears bullish, traders should remain cautious and monitor key indicators:

- Resistance Levels: A breakout above $112,000 could trigger a rapid upward movement.

- Market Sentiment: Shifts in investor confidence can lead to sudden price swings.

- Regulatory Developments: Changes in global crypto regulations may impact market dynamics.

As always, diversification and risk management are crucial in navigating the volatile crypto landscape.

Final Thoughts

Bitcoin’s rebound in CAGR and its ability to hold key support levels suggest that the cryptocurrency is poised for further growth. While the $168,000 target by October is ambitious, historical trends and current market conditions provide a compelling case for optimism. Whether you’re a long-term holder or an active trader, staying informed and adaptable will be key to capitalizing on Bitcoin’s next major move.

What’s your take on Bitcoin’s price trajectory? Share your thoughts in the comments below!