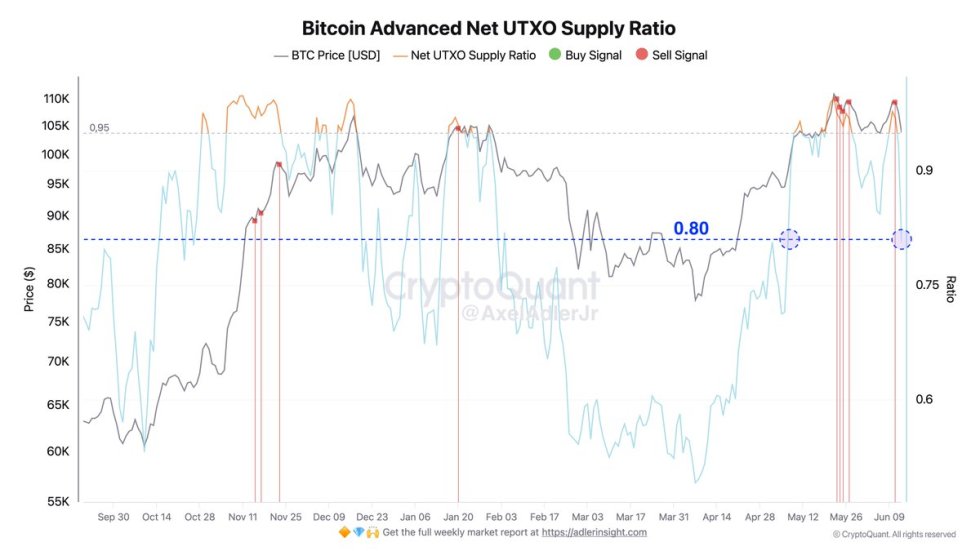

Bitcoin’s UTXO Ratio Signals Potential Buying Opportunity

Bitcoin investors received an intriguing signal this week as the advanced UTXO (Unspent Transaction Output) ratio dropped sharply following recent market turbulence. This technical indicator often precedes price recoveries, suggesting we might be seeing the early stages of a new accumulation phase.

Geopolitical Tensions Trigger Market Sell-Off

The cryptocurrency market faced significant pressure after Israel’s preemptive strike on Iran reignited Middle East tensions. This geopolitical shockwave sent risk assets tumbling across global markets, with Bitcoin experiencing:

- Over 5% price decline within hours

- Brief dip below key moving averages

- Increased liquidations on major exchanges

Understanding the UTXO Ratio Signal

The UTXO ratio measures the proportion of Bitcoin’s circulating supply that has remained unspent for specific time periods. A sharp decline in this ratio after a local peak often indicates:

- Long-term holders absorbing sell pressure

- Potential exhaustion of downward momentum

- Historical precedent for price rebounds

What This Means for Investors

While no indicator is perfect, the UTXO ratio drop combined with recent price action suggests:

- Short-term volatility may continue as markets digest geopolitical news

- Accumulation opportunities could be emerging for patient investors

- Key support levels should be monitored for confirmation of a bottom

Navigating the Current Market

For traders and investors considering positions:

- Dollar-cost averaging may help mitigate timing risks

- Watch for confirmation of the UTXO signal with price action

- Maintain appropriate risk management given ongoing geopolitical uncertainty

As always in cryptocurrency markets, caution remains warranted. However, for those with a longer-term perspective, these technical signals combined with recent price drops may present interesting opportunities in the world’s leading digital asset.