The Return of the Bitcoin Whale: What October Holds for DeFi and Crypto Markets

This week, the crypto landscape was abuzz with excitement as an astonishing $11 billion Bitcoin whale made its return to the market. This development has sparked conversations around the potential trading opportunities that October may bring, particularly in light of the historical rallies seen in previous years. As we delve into the dynamics of this scenario, let’s explore what this means for the decentralized finance (DeFi) sector and the broader cryptocurrency market.

Understanding the Whale’s Impact

In the world of cryptocurrency, a “whale” refers to an individual or entity that holds a substantial amount of a particular cryptocurrency. The recent activity from this Bitcoin whale has garnered attention because such players can significantly influence market dynamics. When a whale enters the market, it often signals potential volatility and trading opportunities.

Historically, the month of October has been known for its bullish trends in the crypto space. Many traders and investors are hopeful that this whale’s return could be a precursor to another significant rally, reminiscent of those seen in previous years. The uncertainty surrounding regulatory moves in the United States adds another layer of intrigue, as market participants speculate on how forthcoming decisions may affect prices.

The Growing DeFi Market

Alongside the resurgence of Bitcoin’s activity, the DeFi sector continues to experience remarkable growth. Decentralized finance has transformed how individuals interact with financial services, offering alternatives to traditional banking systems. By removing intermediaries, DeFi platforms empower users with greater control over their assets and increased access to various financial products.

The synergy between the return of a major player and the thriving DeFi ecosystem could create a unique environment for traders and investors. As this whale seeks to capitalize on potential price movements, it may also bolster interest in DeFi products, leading to increased liquidity and innovation within the space.

What to Watch For in October

As we move further into October, market participants should keep a close eye on several key factors:

- Market Sentiment: The general sentiment within the crypto community can greatly influence price movements. Positive news or developments often encourage bullish behavior, while uncertainty can lead to sell-offs.

- Regulatory News: Any announcements regarding regulation in the U.S. or other major markets could sway investor confidence, impacting both Bitcoin and DeFi projects.

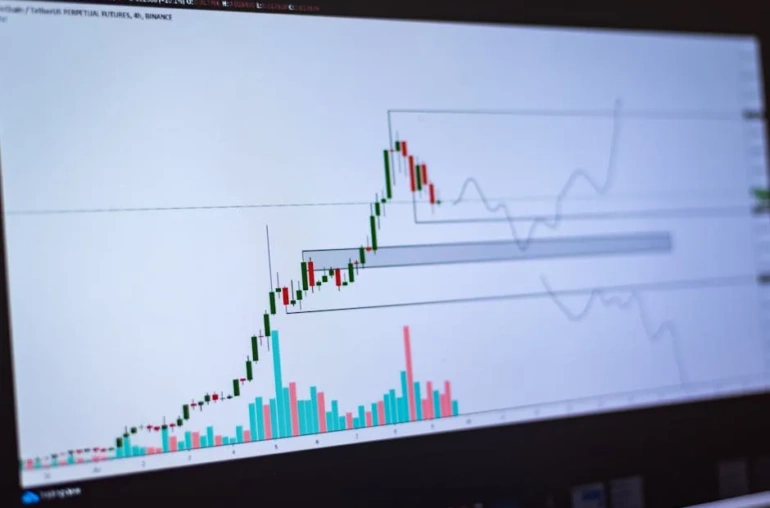

- Whale Activity: Tracking the movements of this Bitcoin whale and others can provide insights into market trends. Sudden large transactions can indicate shifts in market sentiment.

Conclusion

As October unfolds, the return of this $11 billion Bitcoin whale brings with it a wave of potential opportunities and challenges. With the historical bullishness of the month combined with the ongoing evolution of DeFi, traders and investors alike are poised to navigate an exciting and possibly transformative period in the crypto markets. Staying informed and adaptable will be crucial for those looking to capitalize on the upcoming trends in this dynamic sector.