The Dangers of Quick Gains: Arthur Hayes Warns Bitcoin Investors

In the ever-evolving world of cryptocurrency, many investors are drawn to the allure of quick riches. However, Arthur Hayes, co-founder of BitMEX, has a stark warning for those who believe they can purchase Bitcoin today and drive away in a Lamborghini tomorrow. He emphasizes that such a mindset is fundamentally flawed and could lead to significant financial losses.

Understanding the Mindset

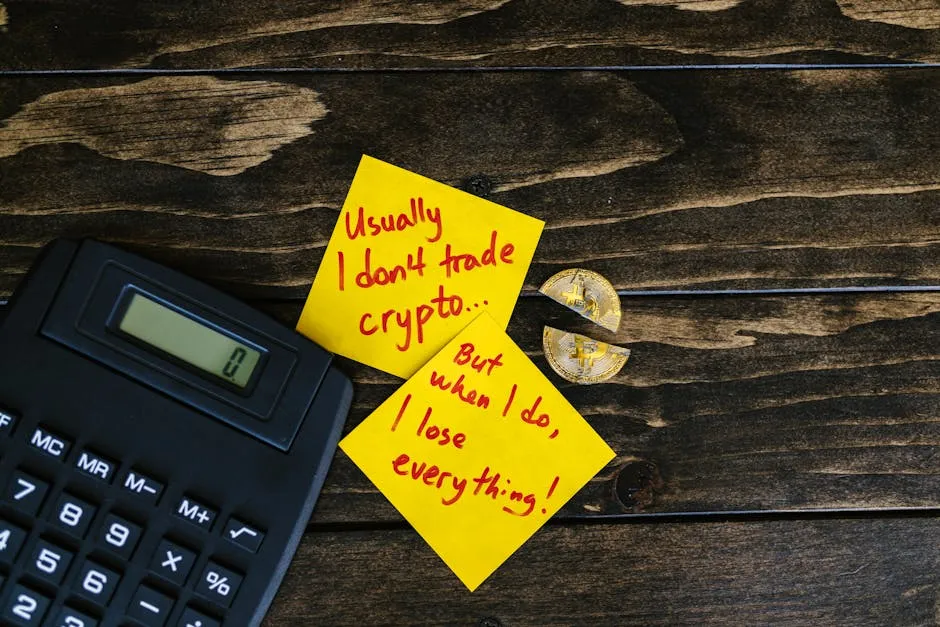

Hayes highlights a common pitfall among new Bitcoin investors: the expectation of rapid returns. The notion of buying Bitcoin one day and reaping massive rewards the next is enticing but unrealistic. Hayes argues that this approach overlooks the complexities of the market and the inherent volatility of cryptocurrencies.

“Chasing after quick profits is not the right way to think about things,” Hayes says. Instead, he advocates for a more measured and patient investment strategy. This means recognizing that cryptocurrency is not just a ticket to instant wealth but rather a long-term investment that requires careful analysis and understanding.

The Reality of Cryptocurrency Investments

Investing in Bitcoin and other cryptocurrencies can indeed be lucrative. However, it is accompanied by significant risks. The market is known for its price fluctuations, which can happen in a matter of hours. For instance, Bitcoin’s value may soar one day and plummet the next, leaving unprepared investors in dire straits.

Hayes encourages investors to adopt a mindset focused on the long-term potential of Bitcoin rather than short-term gains. This involves researching the underlying technology, understanding market trends, and being aware of external factors that can influence prices, such as regulatory changes or macroeconomic conditions.

Strategies for Success

For those looking to navigate the crypto landscape successfully, Hayes offers several strategies:

- Conduct Thorough Research: Before making any investment, take the time to understand the cryptocurrency market, including its history, trends, and potential future developments.

- Diversify Your Portfolio: Rather than putting all your funds into Bitcoin, consider diversifying across different cryptocurrencies and investment vehicles to mitigate risk.

- Stay Informed: Keep up with news and developments in the crypto space. Market conditions can change rapidly, and being informed can help you make better investment decisions.

- Be Patient: Understand that significant returns often take time. Resist the urge to chase quick profits and focus on the long-term growth potential of your investments.

Conclusion

Arthur Hayes’ insights serve as a crucial reminder for both novice and seasoned investors in the cryptocurrency market. While the dream of quick profits is alluring, it is essential to approach Bitcoin and other cryptocurrencies with caution, awareness of market dynamics, and a long-term perspective. By shifting the focus from immediate gains to sustainable investment strategies, investors can better navigate the complexities of the crypto world and potentially achieve lasting success.