Introduction to Wayfinder’s AI Trading Agents

The world of cryptocurrency is constantly evolving, and Wayfinder is at the forefront of this revolution with the introduction of its innovative cross-chain trading AI agents. By integrating support for HyperliquidEVM, Wayfinder aims to enhance trading efficiency and accessibility across multiple blockchain platforms. This development marks a significant step in the realm of automated trading solutions, paving the way for both novice and experienced traders to optimize their strategies.

Understanding Cross-Chain Trading

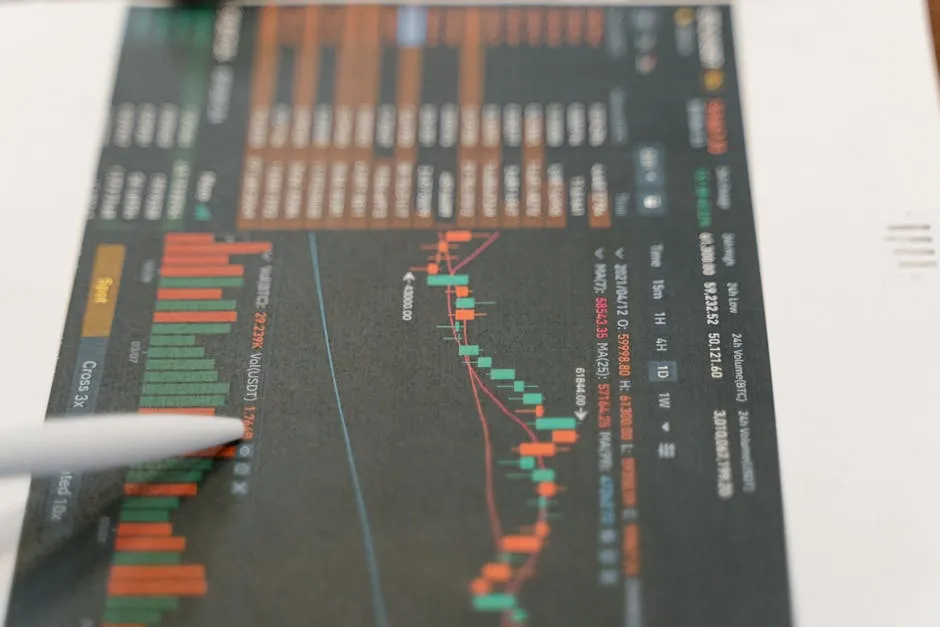

Cross-chain trading refers to the ability to conduct transactions across different blockchain networks. This capability is crucial in a fragmented cryptocurrency market where various tokens and assets exist on separate blockchains. By employing AI agents, Wayfinder enables seamless transitions between these networks, allowing traders to capitalize on price differences and liquidity across various platforms.

The Role of AI in Trading

Artificial intelligence has been transforming numerous industries, and finance is no exception. Wayfinder’s AI agents leverage advanced algorithms to analyze market trends, execute trades, and manage portfolios in real time. With the ability to process vast amounts of data rapidly, these agents offer a level of precision and speed that human traders may find challenging to match.

What is HyperliquidEVM?

HyperliquidEVM is an extensible layer built on the Ethereum Virtual Machine (EVM) that facilitates improved liquidity and trading capabilities. By incorporating HyperliquidEVM into its framework, Wayfinder enhances the functionality of its AI agents, allowing them to interact with a broader range of decentralized finance (DeFi) applications. This integration not only boosts the agents’ operational efficiency but also supports a wider array of trading strategies.

Benefits of Wayfinder’s AI Trading Agents

- Increased Efficiency: The AI agents operate continuously, monitoring market conditions and executing trades without the need for human intervention.

- Data-Driven Insights: By utilizing AI, traders gain access to actionable insights derived from extensive market analysis, helping them make informed decisions.

- Enhanced Liquidity: The integration with HyperliquidEVM ensures that trades can be executed quickly and at optimal prices, reducing slippage.

- Accessibility: These AI agents are designed to cater to both new and experienced traders, democratizing access to sophisticated trading strategies.

The Future of Crypto Trading with Wayfinder

As the cryptocurrency landscape continues to grow, the demand for efficient trading solutions is more crucial than ever. Wayfinder’s introduction of cross-chain trading AI agents represents a significant leap towards achieving greater liquidity and efficiency in the market. By harnessing the power of AI and the capabilities of HyperliquidEVM, Wayfinder is not only simplifying the trading process but also empowering users with advanced tools to navigate the complex world of crypto.

Conclusion

Wayfinder’s innovative approach to integrating AI with cross-chain trading is set to redefine how traders interact with cryptocurrency markets. As these AI agents become more prevalent, we can anticipate a more dynamic and efficient trading environment that benefits all participants. Keep an eye on Wayfinder as it continues to lead the charge in crypto innovation.