Anthony Pompliano’s Bold Move: A $750M Bitcoin Fund

Anthony “Pomp” Pompliano, a well-known figure in the crypto space, is making headlines again—this time with plans to launch a massive $750 million Bitcoin investment fund. As institutional interest in cryptocurrency surges under a crypto-friendly U.S. administration, Pompliano’s ambitious venture could mark a pivotal moment for Bitcoin adoption.

Why This Fund Matters

Pompliano’s fund isn’t just another crypto play—it’s a strategic bet on Bitcoin’s long-term value. Here’s why investors are paying attention:

- Institutional Confidence: A $750M war chest signals strong institutional belief in Bitcoin’s future, potentially attracting more big-money players.

- Regulatory Tailwinds: With a supportive White House and clearer crypto regulations, the timing aligns perfectly for large-scale investments.

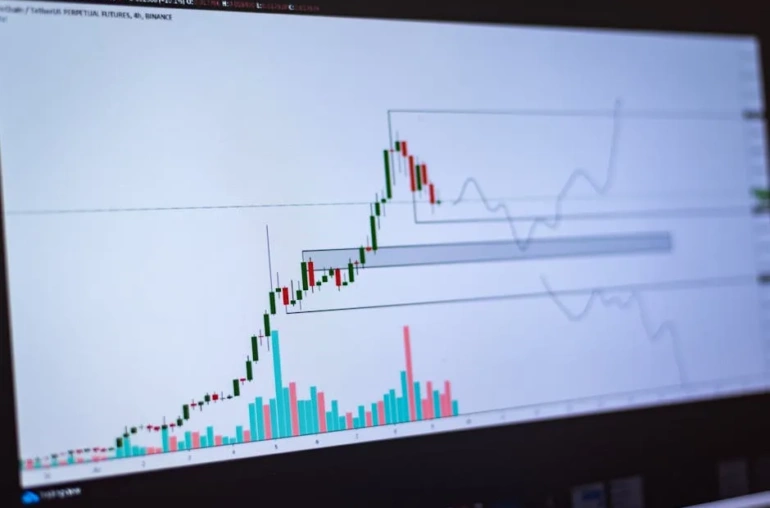

- Market Momentum: Bitcoin’s resilience post-2022 crash and growing ETF approvals highlight renewed bullish sentiment.

The Bigger Picture: Crypto’s Institutional Surge

Pompliano’s fund joins a wave of institutional moves into crypto. BlackRock’s Bitcoin ETF, MicroStrategy’s relentless BTC acquisitions, and Wall Street’s growing crypto desks all point to one trend: digital assets are going mainstream. This fund could accelerate that shift, bridging the gap between traditional finance and decentralized innovation.

Challenges Ahead

While the opportunity is vast, hurdles remain. Regulatory scrutiny, market volatility, and competition from other asset managers could impact the fund’s performance. However, Pompliano’s track record—from early Bitcoin advocacy to Morgan Creek Digital’s successes—suggests he’s prepared to navigate these challenges.

What’s Next for Investors?

For retail and institutional investors alike, this fund represents a chance to gain exposure to Bitcoin through a managed, high-conviction vehicle. As Pompliano finalizes the fund’s structure, here are key takeaways:

- Watch the White House: Policy shifts could further boost or hinder crypto inflows.

- Diversify Strategically: Even with Bitcoin’s potential, balancing crypto holdings with traditional assets remains prudent.

- Stay Informed: Follow Pompliano’s announcements for insights into the fund’s launch timeline and investment strategy.

With $750 million on the line, Pompliano’s Bitcoin fund isn’t just a bet on cryptocurrency—it’s a bet on the future of finance itself. Whether you’re a HODLer or a skeptic, this development is worth watching closely.