World Liberty Financial’s Ethereum Acquisition Surges to $296 Million

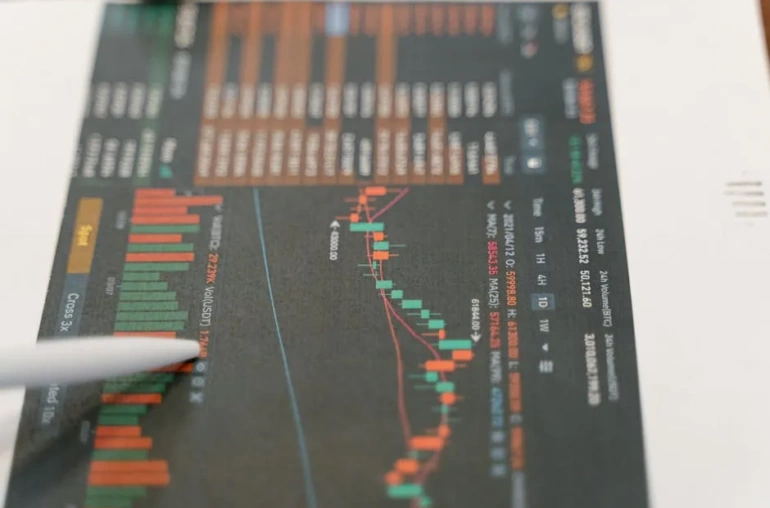

In a notable development in the cryptocurrency world, World Liberty Financial (WLFI), a decentralized finance (DeFi) firm backed by former President Donald Trump, continues its aggressive expansion in the Ethereum market. As of July 29, WLFI has made headlines by adding another substantial batch of Ethereum (ETH) to its holdings, pushing its total investment in the cryptocurrency to an impressive $296 million.

WLFI’s Buying Spree

According to data from Lookonchain, WLFI recently purchased an additional 256.75 ETH. This latest acquisition is part of a broader strategy by the firm to capitalize on rising prices and increasing interest in decentralized finance solutions. With Ethereum’s price showing resilience and potential for further growth, WLFI’s move reflects a confidence in the future of the cryptocurrency market.

The Role of DeFi in Today’s Financial Landscape

Decentralized finance has transformed how individuals and institutions approach financial services. By leveraging blockchain technology, DeFi platforms like WLFI offer users the ability to participate in a range of financial activities without the need for traditional banking systems. This democratization of finance has attracted significant investment, particularly from high-profile backers like Trump, signaling a shift in how mainstream figures view the cryptocurrency space.

What’s Next for WLFI?

As WLFI continues to increase its stake in Ethereum, industry watchers are keen to see how this will impact both the firm and the broader DeFi landscape. The company’s commitment to building its Ethereum portfolio indicates a strategy focused on long-term growth and innovation. With the market evolving rapidly, WLFI may also explore other cryptocurrencies or DeFi projects to diversify its investments further.

The Impact of High-Profile Support

The backing of a prominent figure like Donald Trump adds an intriguing layer to WLFI’s narrative. His involvement could potentially attract more investors who might have previously been hesitant to enter the cryptocurrency market. This could lead to increased legitimacy and interest in the DeFi sector, positioning WLFI as a key player in the ongoing evolution of finance.

Conclusion

As World Liberty Financial continues to build its Ethereum stack, the firm is not only contributing to its own growth but also participating in a larger movement towards decentralization in finance. Investors and enthusiasts alike will be watching closely to see how WLFI navigates the complexities of the cryptocurrency market and what strategies it will implement to maintain its competitive edge. The future of DeFi is bright, and with firms like WLFI leading the charge, the possibilities are endless.