US Investors Are Driving Bitcoin’s Price Surge—Here’s How

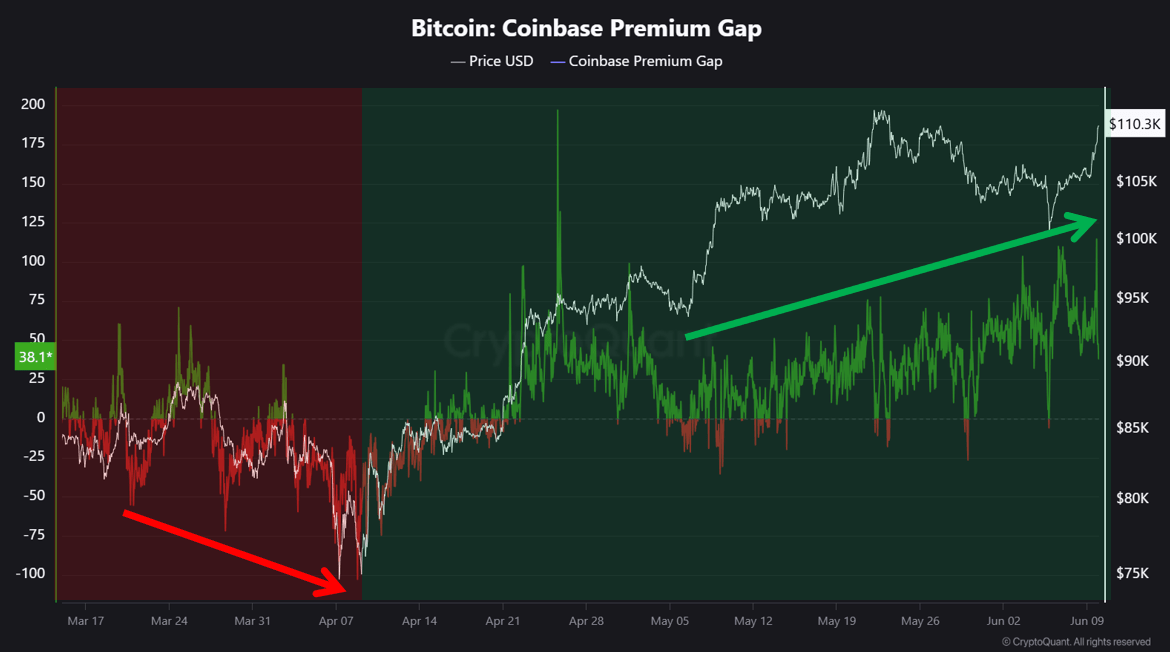

Bitcoin’s recent rally isn’t just retail hype—data suggests American institutional players are stepping in. The Coinbase Premium Gap, a key metric tracking the difference between Bitcoin prices on Coinbase (a US-heavy exchange) and Binance (global), has turned green, signaling strong demand from US-based whales. But what does this mean for the market?

What Is the Coinbase Premium Gap?

The Coinbase Premium Gap measures the price difference for Bitcoin between Coinbase Pro and Binance. When this gap is positive, it indicates higher buying pressure from US investors, often institutional. Recently, the gap has widened, suggesting:

- Institutional accumulation: Large entities are buying Bitcoin at a premium.

- US-led demand: American investors are outpacing global markets.

- Bullish sentiment: Confidence in Bitcoin’s long-term value is growing.

Why Are US Whales Betting Big on Bitcoin?

Several factors could explain the surge in institutional interest:

- ETF inflows: Spot Bitcoin ETFs continue to attract capital, with BlackRock and Fidelity leading the charge.

- Macroeconomic shifts: Inflation concerns and a weakening dollar may be pushing investors toward hard assets.

- Regulatory clarity: The SEC’s approval of Bitcoin ETFs has reduced uncertainty for US institutions.

What This Means for Retail Investors

While whale activity can drive short-term volatility, it often signals long-term confidence. Here’s how to interpret the trend:

- Watch the gap: A sustained premium suggests institutional accumulation isn’t slowing.

- Dollar-cost average (DCA): Avoid FOMO by sticking to a disciplined strategy.

- Monitor ETF flows: Large inflows could further propel Bitcoin’s price.

The Bottom Line

The rising Coinbase Premium Gap is a clear indicator that US institutions are backing Bitcoin’s rally. For retail investors, this underscores the importance of tracking on-chain metrics alongside price action. While short-term corrections are possible, the long-term outlook appears increasingly bullish.

Want deeper insights? Follow institutional trends and key metrics like the Coinbase Premium Gap to stay ahead of the curve.