USDD Expands to Ethereum: A Major Step Towards Multi-Chain Dominance

In a significant development for the decentralized finance (DeFi) landscape, USDD has officially launched on the Ethereum blockchain. This expansion marks a pivotal moment for the stablecoin, which originally gained traction on the Tron network. With this move, USDD aims to achieve true multi-chain dominance and integrate more deeply into the core infrastructure of DeFi.

The Vision Behind USDD’s Expansion

Backed by Justin Sun, the founder of Tron, USDD’s launch on Ethereum is designed to leverage the deep liquidity that Ethereum offers. The decision to broaden the stablecoin’s availability is not merely a strategic business move; it reflects a vision to create a more interconnected and robust DeFi ecosystem. By establishing a presence on Ethereum, USDD can now cater to a wider audience and enhance its usability across various decentralized applications (dApps).

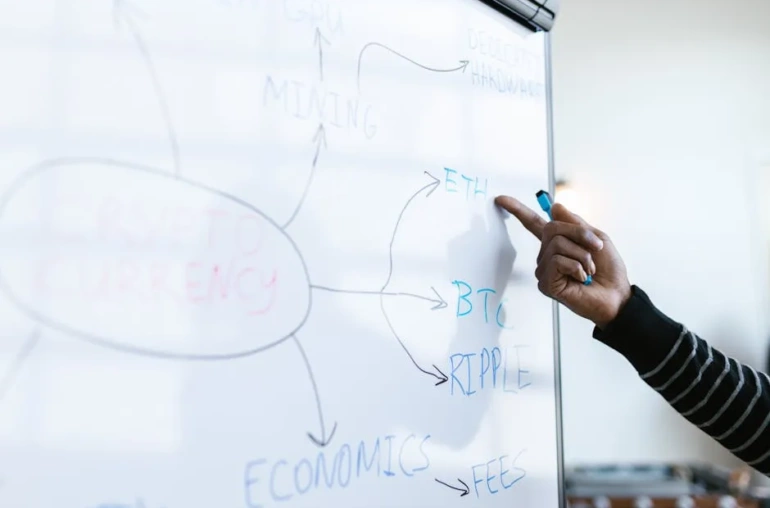

Why Ethereum?

Ethereum is renowned for its significant liquidity and vast user base, making it an optimal choice for any project looking to expand its reach. The blockchain is home to numerous DeFi protocols, which facilitate lending, borrowing, and trading of digital assets. By integrating with Ethereum, USDD stands to benefit from the existing infrastructure, tapping into the established networks that already exist on the platform.

Implications for the DeFi Space

The entry of USDD into the Ethereum ecosystem is expected to create ripples across the DeFi landscape. As a stablecoin, USDD provides a stable medium of exchange, which is essential for users looking to navigate the often volatile cryptocurrency market. This stability can encourage more users to engage with DeFi platforms, further driving adoption and innovation in the space.

Moreover, USDD’s presence on Ethereum could lead to enhanced liquidity for various DeFi projects, as users now have the option to utilize a stablecoin that is directly tied to one of the most popular blockchains in the world. The integration of USDD with Ethereum-based dApps could streamline transactions, making it easier for users to swap between assets, earn yields, and access financial services.

Looking Ahead

The launch of USDD on Ethereum is just the beginning of a broader strategy aimed at establishing the stablecoin as a dominant player in the multi-chain ecosystem. As DeFi continues to evolve, USDD’s expansion is a clear indication of the increasing importance of interoperability among different blockchain networks.

In conclusion, USDD’s integration into Ethereum represents a significant milestone not only for the stablecoin itself but also for the future of decentralized finance. As more projects look to create multi-chain solutions, USDD’s commitment to expanding its reach could set a precedent for others in the industry.