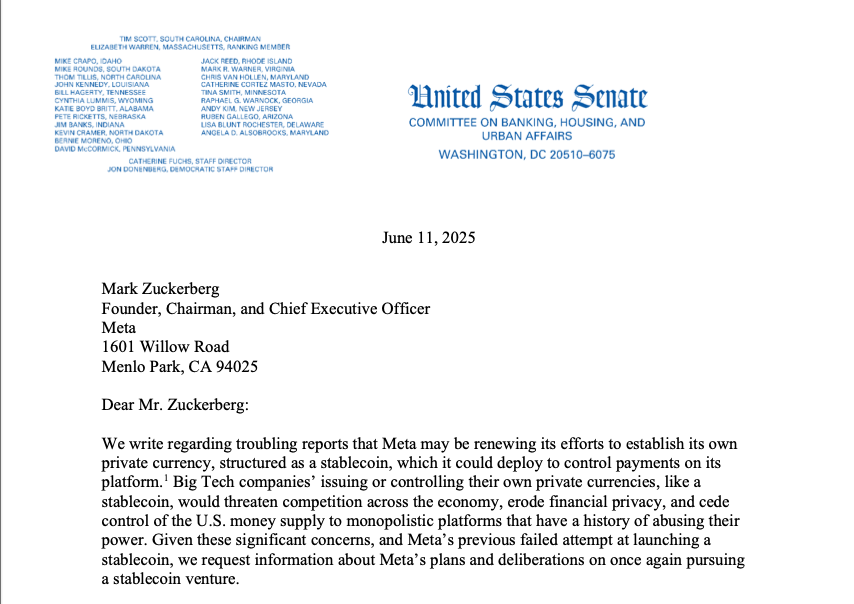

US Senators Raise Alarm Over Meta’s Stablecoin Ambitions

In a recent development that underscores growing regulatory scrutiny of Big Tech’s foray into digital currencies, two US senators have sent a pointed letter to Meta CEO Mark Zuckerberg demanding clarity on the company’s reported stablecoin plans. The move comes amid increasing concerns about privacy, financial sovereignty, and the potential risks of tech giants issuing private currencies.

Why Are Lawmakers Concerned?

The senators’ letter highlights several critical issues:

- Privacy risks: Meta’s history with data handling (notably the Cambridge Analytica scandal) raises questions about how user financial data might be managed.

- Market dominance: With billions of global users, a Meta-issued stablecoin could quickly achieve systemic importance, potentially undermining traditional financial systems.

- Regulatory gaps: Current US crypto legislation remains fragmented, creating uncertainty about how such a project would be overseen.

Meta’s Rocky History With Digital Currency

This isn’t Meta’s first attempt at creating a digital payment system. The company previously launched the Diem stablecoin project (originally Libra), which faced intense regulatory pushback before being abandoned in 2022. The senators’ letter explicitly references this failed initiative, questioning how the new approach would differ.

Key Questions From the Letter:

- Will Meta’s stablecoin comply with existing anti-money laundering (AML) and know-your-customer (KYC) regulations?

- How will user financial data be segregated from Meta’s advertising ecosystem?

- What measures will prevent the stablecoin from becoming a de facto global reserve currency?

The Bigger Picture: Tech Giants and Financial Power

This confrontation reflects a broader debate about the role of technology companies in the financial sector. As stablecoins like USDT and USDC gain mainstream adoption, regulators are increasingly concerned about:

- Systemic risks if a stablecoin fails (akin to a bank run)

- Potential erosion of monetary policy effectiveness

- Consumer protection in decentralized systems

The senators’ intervention suggests that any Meta stablecoin project will face an uphill battle in Washington. With bipartisan support growing for comprehensive crypto regulation, the company may need to make significant concessions or risk another high-profile failure in the payments space.

What do you think about tech companies issuing stablecoins? Should there be stricter limits on their financial ambitions? Share your thoughts in the comments below.