Understanding the Recent Crypto Market Crash: Short-Term Factors and Long-Term Outlook

The cryptocurrency market recently experienced a significant downturn, leading to widespread concern among investors and traders alike. This crash, described by analysts as a result of a “perfect storm” of short-term factors, resulted in a staggering $20 billion in liquidations—the most substantial 24-hour loss in the history of crypto trading.

What Caused the Crash?

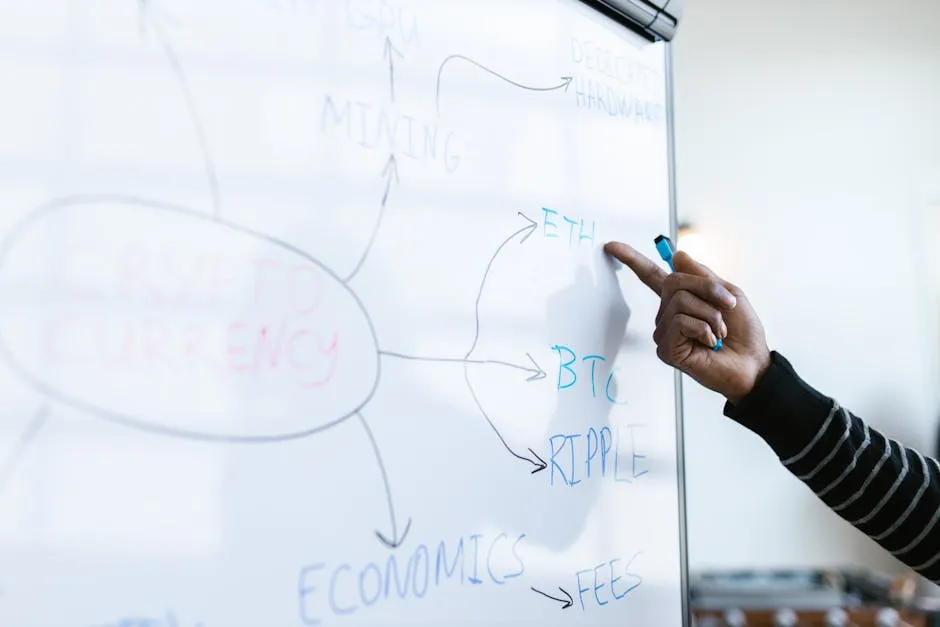

While the exact triggers of this market crash are multifaceted, they primarily stem from a combination of short-term market movements and external pressures. Several key factors contributed to the sudden downturn:

- Market Sentiment: Negative news and sentiment can have an outsized impact on crypto markets, often leading to panic selling.

- Liquidations: The crash was exacerbated by a high number of leveraged positions being liquidated, forcing traders to sell their assets at a loss.

- Regulatory Concerns: Ongoing discussions about regulatory measures in various countries have caused uncertainty, prompting many to withdraw from the market.

Short-Term Factors and Their Impact

Experts suggest that the recent market crash should be viewed through the lens of short-term factors rather than as a signal of a longer-term decline in the market’s fundamentals. Analysts have reassured investors that these fluctuations are often part of the volatile nature of the crypto space.

According to industry analysts, the conditions leading to this crash—though severe—do not reflect a fundamental weakness in the cryptocurrency ecosystem itself. Instead, they highlight the inherent volatility and speculative nature of the market. It is important to understand that such downturns can often be temporary, influenced by immediate market reactions rather than underlying economic trends.

Looking Ahead: What Does This Mean for Investors?

For investors, this presents a crucial moment to reassess their strategies. Here are a few considerations:

- Stay Informed: Keeping up-to-date with market trends and regulatory developments is essential for making informed investment decisions.

- Diversify Investments: Consider diversifying your portfolio to mitigate risks associated with market volatility.

- Long-Term Perspective: Many analysts advocate maintaining a long-term perspective rather than making hasty decisions based on short-term fluctuations.

In conclusion, while the recent crypto market crash has stirred concerns, analysts emphasize that it does not have long-term fundamental implications for the industry. The combination of short-term factors that led to this situation is not uncommon in the cryptocurrency landscape. By understanding these dynamics, investors can better navigate the complexities of the market and make informed decisions moving forward.