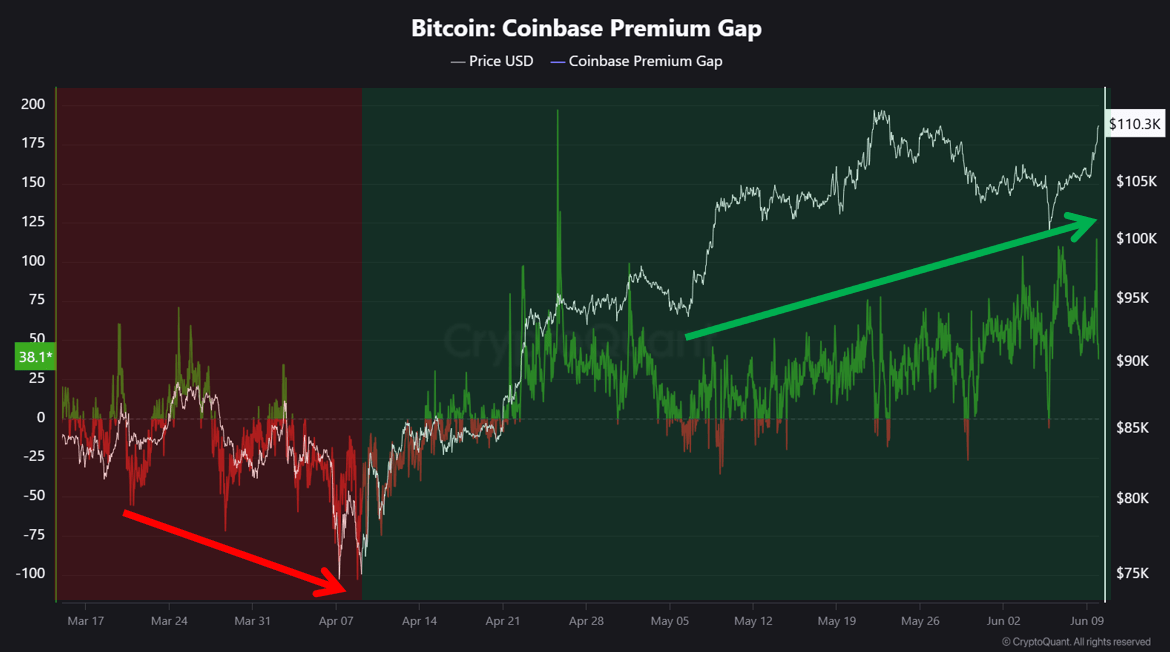

U.S. Institutional Investors Fuel Bitcoin Rally as Coinbase Premium Gap Widens

Recent data reveals a significant uptick in the Bitcoin Coinbase Premium Gap, signaling heightened buying activity from large U.S.-based investors. This trend suggests that institutional players may be driving the latest Bitcoin price surge, reinforcing confidence in the cryptocurrency’s upward momentum.

What Is the Coinbase Premium Gap?

The Coinbase Premium Gap measures the difference between Bitcoin’s price on Coinbase (a U.S.-centric exchange popular with institutions) and Binance (a global exchange with a broader retail user base). When the gap turns positive, it indicates stronger buying pressure on Coinbase—often a sign of institutional or “whale” activity.

According to a CryptoQuant analyst, the premium has recently turned green, reflecting increased demand from deep-pocketed investors. This aligns with Bitcoin’s recent price rally, which saw the cryptocurrency break key resistance levels.

Why Does This Matter?

Institutional involvement is a critical factor in Bitcoin’s long-term adoption and price stability. When large investors accumulate Bitcoin, it often leads to:

- Reduced volatility: Institutional buying can stabilize prices by absorbing sell pressure.

- Increased liquidity: More institutional participation improves market depth.

- Mainstream validation: Big-money backing reinforces Bitcoin’s role as a legitimate asset class.

The Bigger Picture: Institutional Adoption Grows

This trend isn’t isolated. The surge in the Coinbase Premium Gap follows other bullish signals, including:

- The approval of spot Bitcoin ETFs in the U.S., which have attracted billions in inflows.

- Growing interest from corporate treasuries and hedge funds.

- Positive regulatory developments, such as clearer crypto frameworks in key markets.

As institutional players continue to enter the market, Bitcoin’s role as “digital gold” gains further credibility. For retail investors, monitoring metrics like the Coinbase Premium Gap can provide valuable insights into market sentiment and potential price movements.

What’s Next for Bitcoin?

While short-term fluctuations are inevitable, the widening premium gap suggests sustained institutional interest. If this trend persists, Bitcoin could see further upside, especially with the upcoming halving event in 2024—a historically bullish catalyst.

For now, all eyes remain on U.S. investor behavior and macroeconomic factors like interest rates and inflation, which could influence Bitcoin’s trajectory in the coming months.