A Major Player Reduces Its Ethereum Stash

The cryptocurrency market is witnessing a significant shift in holdings from a major institutional player. Trend Research, a prominent investment firm, has reportedly sold off a massive amount of Ethereum (ETH) in recent days. According to on-chain data and market reports, the firm has moved over 400,000 ETH, worth hundreds of millions of dollars, to exchanges like Binance, signaling a major reduction in its exposure to the second-largest cryptocurrency.

Why the Sudden Sell-Off?

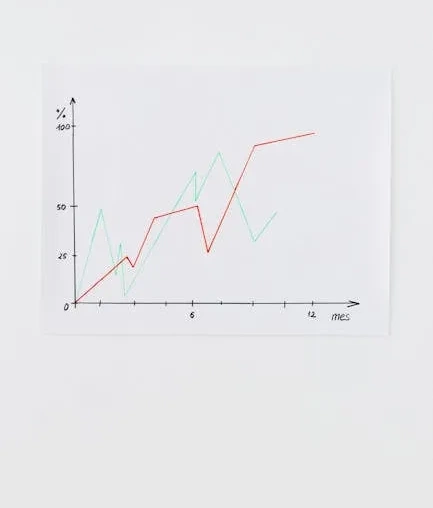

The primary driver behind this large-scale divestment appears to be risk management. Analysis suggests that Trend Research had significant leveraged positions tied to Ethereum. As the price of ETH began to decline and approach the critical threshold of $1,700, it neared what are known as “liquidation levels” for the firm’s loans.

In the world of decentralized finance (DeFi) and crypto lending, users often borrow funds by using their cryptocurrency as collateral. If the value of that collateral falls too close to the value of the loan, the position faces automatic liquidation—a forced sale to repay the lender and prevent a loss. For Trend Research, the $1,700 mark was identified as a key danger zone where such liquidations could be triggered.

Preemptive Action to Avoid a Crisis

By proactively selling a large portion of its ETH holdings, Trend Research is taking a defensive stance. This move accomplishes two main goals:

- Raising Capital: The sale generates immediate cash (or stablecoins), which can be used to shore up other positions or pay down debt, increasing the overall health of its portfolio.

- Reducing Risk: By decreasing the amount of ETH held, the firm lowers its overall exposure to further price drops. This creates a larger buffer between the current ETH price and its remaining liquidation points, buying time and stability.

This is a classic example of institutional risk management in action, albeit on a massive scale within the volatile crypto market.

What This Means for the Broader Ethereum Market

The actions of a single large entity like Trend Research can have ripple effects across the entire market. The transfer of such a large volume of ETH to exchanges typically increases selling pressure, as it is often a precursor to a sale. This can contribute to downward momentum on the price, at least in the short term.

Furthermore, it highlights the fragility and interconnectedness of the crypto ecosystem. Large, leveraged positions held by institutions can create hidden points of vulnerability. When prices fall, the threat of cascading liquidations—where one forced sale triggers another—becomes a real concern for market stability.

For everyday investors, this event serves as a stark reminder of the importance of understanding leverage and risk. While the potential for high returns exists, the mechanisms of DeFi and crypto lending can amplify losses just as quickly. Monitoring the on-chain activity of large holders, often called “whales,” can provide valuable clues about market sentiment and potential pressure points.

As Ethereum continues to navigate a complex market environment, the defensive maneuvers of major players like Trend Research will be closely watched as an indicator of both confidence and caution in the space.