The Rise of On-Chain Equities

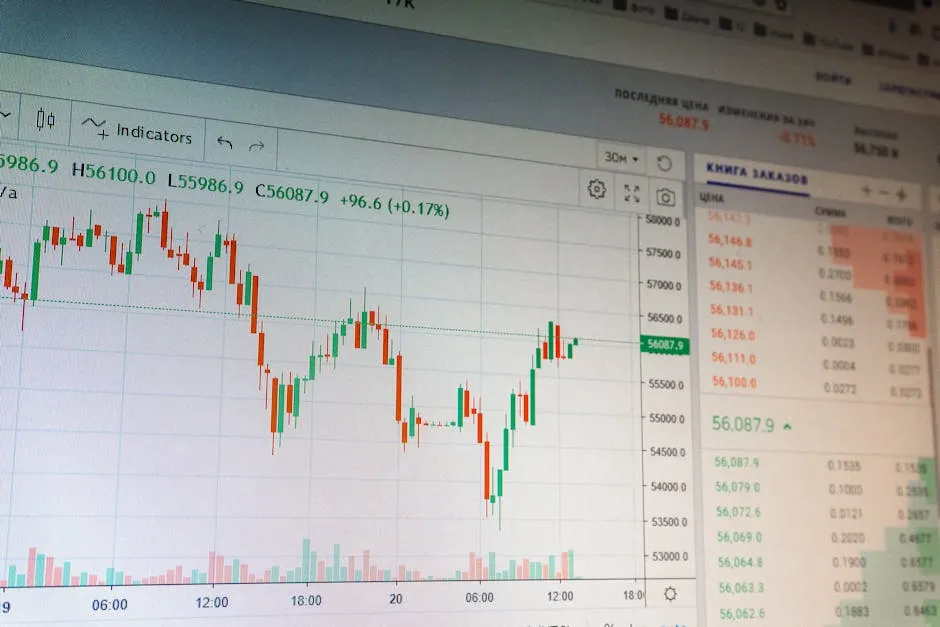

The world of traditional finance is undergoing a quiet but profound transformation, and it’s happening on the blockchain. The concept of tokenized stocks—digital representations of real-world equities—is moving from a niche experiment to a significant market force. Recent data highlights this explosive growth, with platforms like Kraken’s xStocks reporting staggering milestones that signal a major shift in how investors interact with capital markets.

A $25 Billion Milestone

Kraken’s dedicated platform for tokenized equities, xStocks, has officially surpassed $25 billion in cumulative trading volume. This isn’t just a big number; it’s a powerful validation of the underlying technology and growing investor appetite. The volume tells a story of liquidity and adoption, suggesting that these blockchain-based assets are being actively traded, not just held as curiosities.

Perhaps even more telling than the trading volume is the user adoption. The platform now boasts more than 80,000 unique on-chain holders. This metric points to a broad and decentralized user base actively participating in this new financial paradigm. It demonstrates that tokenized equities are attracting a wide range of participants, from crypto-native users to traditional investors seeking exposure through a more efficient, transparent, and accessible medium.

Why Tokenized Stocks Are Gaining Traction

So, what’s driving this rapid expansion? The appeal of tokenized equities lies in several key advantages over traditional systems:

- 24/7 Global Markets: Unlike traditional exchanges with limited hours, blockchain markets can operate around the clock, allowing for trading at any time.

- Enhanced Liquidity and Accessibility: By fractionalizing ownership, these tokens can make high-priced stocks accessible to a wider audience. They also open the door for these assets to be used across a growing ecosystem of decentralized finance (DeFi) applications.

- Transparency and Efficiency: Settlement occurs almost instantly on the blockchain, reducing counterparty risk and the need for complex intermediaries. All transactions are recorded on a public ledger, providing unprecedented transparency.

- Cross-Venue Trading: As noted in industry reports, a significant trend is the expansion of cross-venue trading. These tokenized assets are not siloed on a single platform but can be traded across various compliant crypto exchanges and DeFi protocols, creating a more interconnected and resilient financial network.

The Future of Asset Ownership

The milestone achieved by Kraken’s xStocks is a clear indicator that the tokenization of real-world assets (RWA) is more than just theoretical. It’s a practical, working model that is scaling quickly. As regulatory frameworks continue to evolve and institutional players deepen their involvement, the infrastructure supporting these digital securities will only become more robust.

This movement represents a fundamental convergence of traditional finance and blockchain innovation. It promises a future where ownership of stocks, bonds, and other assets is more democratic, liquid, and integrated into the global digital economy. For investors, it opens a new frontier of opportunity, blending the familiarity of traditional equities with the innovation of crypto.