The Rise of Stablecoin Cards: A Look Ahead to 2026

As the financial landscape continues to evolve, one exciting development on the horizon is the anticipated adoption of stablecoin cards. Leading voices within the crypto venture capital community are predicting that 2026 will be a pivotal year for this transformative payment method. This prediction comes on the heels of a significant funding milestone for fintech startup Rain, which has recently secured $250 million to accelerate the integration of stablecoin payments.

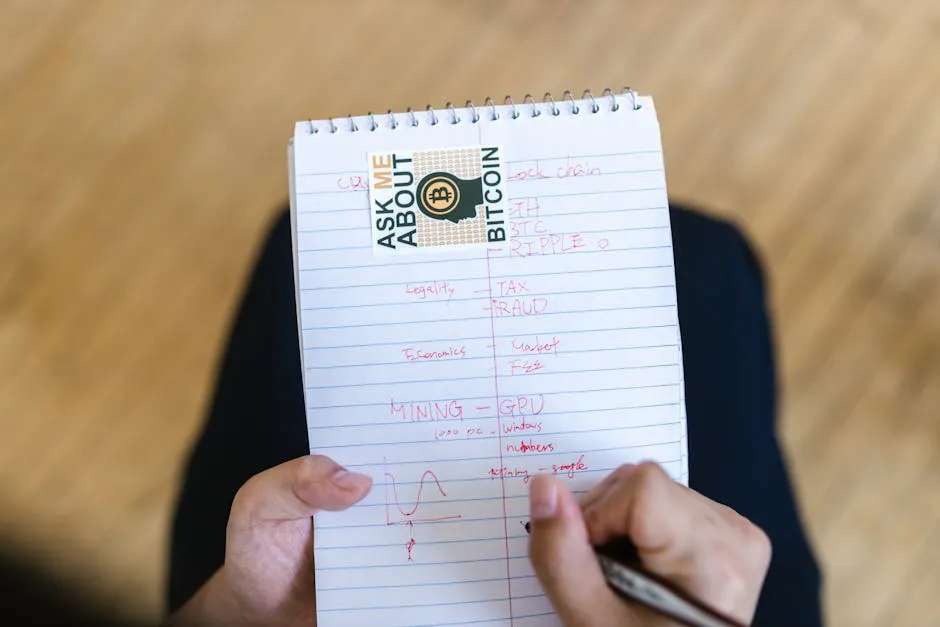

What Are Stablecoin Cards?

Stablecoin cards are payment cards that allow users to transact using stablecoins—cryptocurrencies designed to maintain a stable value by pegging them to stable assets, such as fiat currencies. This innovative payment solution combines the benefits of cryptocurrency with the convenience of traditional payment methods, making it easier for users to spend their digital assets in everyday transactions.

The Role of Rain and Recent Funding

Rain, a notable player in the fintech space, has positioned itself at the forefront of this movement. With the recent injection of $250 million in funding, the startup is poised to enhance its offerings and drive the adoption of stablecoin payments. This investment is seen as a strong endorsement of the potential for stablecoin cards to revolutionize the way consumers interact with their digital assets.

Why 2026?

Experts suggest that several factors will converge in 2026, making it an ideal time for stablecoin card adoption to flourish:

- Increased Regulatory Clarity: As governments around the world establish clearer regulations regarding cryptocurrencies, consumers and businesses will feel more secure in using stablecoin cards.

- Technological Advancements: The ongoing development of blockchain technology and payment systems will enhance the usability and security of stablecoin transactions.

- Growing Acceptance: More merchants are likely to adopt stablecoin payments, providing consumers with more opportunities to use their stablecoin cards in day-to-day purchases.

- Consumer Demand: As awareness of cryptocurrencies grows, consumers are increasingly looking for ways to integrate digital assets into their financial lives, fueling the demand for stablecoin solutions.

Implications for the Future

The rise of stablecoin cards could have profound implications for the financial ecosystem. For consumers, it means greater flexibility and control over their finances, allowing them to spend their digital assets without the volatility typically associated with cryptocurrencies. For businesses, adopting stablecoin payment options could attract a broader customer base, particularly among tech-savvy consumers eager to leverage digital currencies.

Conclusion

As we look towards 2026, the excitement surrounding stablecoin card adoption is palpable. With substantial backing from investors like Dragonfly and the strategic advancements from companies like Rain, the future appears bright for the integration of stablecoins into everyday financial transactions. As this trend unfolds, it will be fascinating to observe how stablecoin cards reshape consumer behavior and redefine the payment landscape.