Understanding Bitcoin’s 21 Million Hard Cap

Bitcoin, the pioneering cryptocurrency, was designed with a strict limit of 21 million coins. This hard cap is a fundamental aspect of its economic model, intended to create scarcity and prevent inflation. Since its inception, there have been discussions and attempts to change this limit, but such efforts have faced significant obstacles. In this article, we will explore the history surrounding the 21 million hard cap and the reasons why altering it is a complex challenge.

The Origins of Bitcoin’s Hard Cap

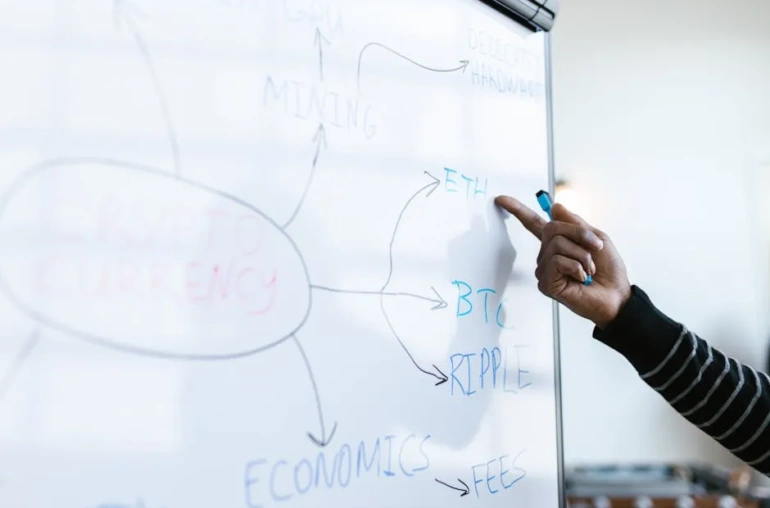

Bitcoin was introduced by an anonymous entity known as Satoshi Nakamoto in 2009. One of the defining features of Bitcoin’s protocol is its limited supply, which was set to ensure that new coins are gradually introduced into the ecosystem. The idea was to mimic precious metals like gold, where scarcity contributes to value. The 21 million cap was established to create a predictable and deflationary currency over time.

The Attempts to Change the Cap

Over the years, there have been various discussions within the cryptocurrency community about the possibility of changing Bitcoin’s hard cap. Most of these discussions arise during periods of market volatility or economic downturns, where some argue that increasing the supply could help stabilize prices or fund development. However, attempts to amend this limit have consistently met with resistance.

Community Pushback

The decentralized nature of Bitcoin means that any significant change requires consensus among a broad array of stakeholders, from miners and developers to holders and users. The overwhelming sentiment within the community is one of preservation. Many view the hard cap as a critical component of Bitcoin’s value proposition. Altering it could undermine trust and stability, leading to a loss of confidence in the currency itself.

Technical Challenges

From a technical standpoint, changing the hard cap would necessitate a hard fork—a permanent divergence in the blockchain. This is no small feat. A hard fork requires a substantial portion of the network to agree on the changes and adopt the new version of the protocol. Given Bitcoin’s established network effects and the significant resources that would need to be committed to promote a new version, the risks of fragmentation are high. Numerous past attempts to fork Bitcoin have resulted in alternative cryptocurrencies with limited success and adoption.

Why Alternatives Struggle to Compete

Even when forks or new cryptocurrencies emerge claiming to address Bitcoin’s limitations, they often struggle to gain traction. Bitcoin is often seen as the “gold standard” of digital currencies, and its established user base creates a significant barrier for newcomers. Additionally, the network effects that Bitcoin has built over the years make it challenging for any alternative to displace it as the leading cryptocurrency.

Conclusion: The Future of Bitcoin’s Hard Cap

In summary, while the idea of changing Bitcoin’s hard cap may arise in times of economic uncertainty, the consensus among the community remains firmly in favor of maintaining the status quo. The hard cap of 21 million coins is not just a technical specification; it is part of the very essence of Bitcoin’s identity. As the cryptocurrency market continues to evolve, it is likely that Bitcoin will remain steadfast in its commitment to scarcity, reinforcing its position as the apex asset in the digital currency landscape.