Tether CEO Challenges Market Valuation: Is $515B Too Conservative?

In a bold statement that sent ripples through the crypto community, Tether CEO Paolo Ardoino dismissed recent speculation about a potential IPO, suggesting that the company’s rumored $515 billion valuation might actually be “a bit bearish.” His comments highlight Tether’s growing dominance in the stablecoin market and its strategic accumulation of Bitcoin and gold reserves.

Tether’s Expanding Treasury: A Hidden Strength

Ardoino pointed to Tether’s rapidly growing treasury, which includes substantial holdings of Bitcoin and gold, as a key factor justifying a higher valuation. Unlike traditional stablecoin issuers, Tether has diversified its reserves beyond fiat currencies, positioning itself as a hybrid between a stablecoin provider and a crypto asset manager. This strategy has fueled debates about whether the market is underestimating Tether’s long-term potential.

Why an IPO Isn’t on the Table

Despite the staggering valuation estimates, Ardoino confirmed that Tether has no plans to go public. The company’s opaque structure and regulatory scrutiny have long been points of contention, but its profitability and market share (controlling over 70% of the stablecoin market) suggest it may not need public funding. “We’re focused on organic growth and innovation,” Ardoino remarked, hinting at upcoming projects in decentralized finance (DeFi).

Market Reactions and Skepticism

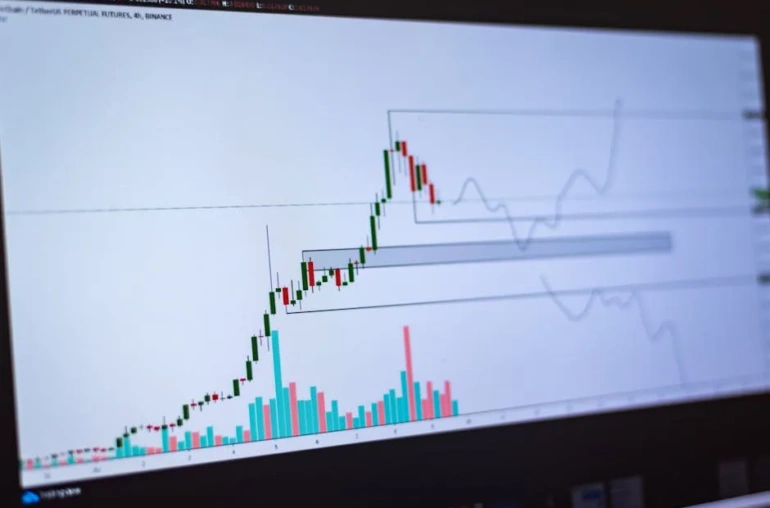

Analysts are divided on whether Tether’s valuation claims hold water. Critics argue that the $515B figure—nearly double Visa’s market cap—is speculative, given Tether’s lack of transparency. However, supporters counter that its Bitcoin and gold reserves, combined with its role as the backbone of crypto trading liquidity, could justify a premium. The debate underscores the challenges of valuing crypto-native enterprises in traditional terms.

The Bottom Line

Tether’s defiance of conventional valuation metrics reflects the broader evolution of crypto finance. Whether the $515B estimate is “bearish” or optimistic, one thing is clear: Tether’s influence on the crypto economy is undeniable, and its next moves will be closely watched.

For more insights on stablecoins and market trends, follow our coverage here.