Lawmakers Raise Alarm Over DOJ’s Crypto Enforcement Decision

A bipartisan group of six U.S. Senators has publicly challenged the Department of Justice (DOJ) over its recent decision to disband a dedicated cryptocurrency enforcement unit. The move by lawmakers comes in response to concerning data, with the senators citing a staggering 162% increase in illicit cryptocurrency activity in 2025 as a primary reason the specialized team should have remained intact.

A Question of Timing and Priority

The senators directed their concerns to Deputy Attorney General Todd Blanche, questioning the logic behind dismantling a focused enforcement arm at a time when crypto-related crime is surging. The specialized unit, known as the National Cryptocurrency Enforcement Team (NCET), was created to tackle the complex, cross-border nature of financial crimes involving digital assets. Its dissolution has sparked debate about the government’s commitment to policing this rapidly evolving sector.

In their inquiry, the lawmakers argued that the specialized knowledge and concentrated focus of the NCET were critical assets. Cryptocurrency investigations often require a unique understanding of blockchain technology, mixing services, and decentralized finance protocols—expertise that can be diluted when folded into broader, more generalized departments.

The Data Driving the Debate

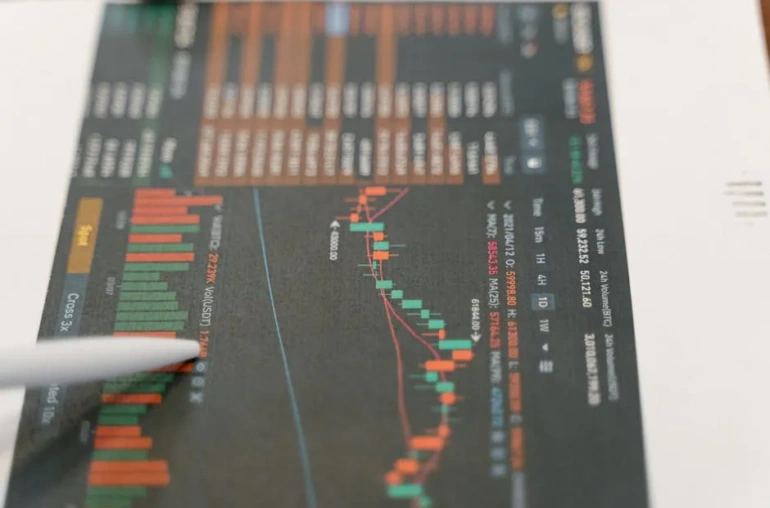

The core of the senators’ argument hinges on the sharp rise in illegal activity. A 162% year-over-year jump is not a minor statistical blip; it represents a significant escalation in the scale and scope of crypto-enabled crime. This includes everything from ransomware attacks and darknet market transactions to sophisticated fraud and money laundering schemes.

By pointing to this data, the senators are making a clear case: the enforcement challenge is growing exponentially, not receding. Shuttering a team designed specifically to address this challenge, therefore, appears counterintuitive to many observers and policymakers focused on consumer protection and financial integrity.

What Happens Next for Crypto Regulation?

This confrontation between the Senate and the DOJ highlights a broader tension in the U.S. approach to digital assets. On one hand, there is a desire to foster innovation and maintain competitiveness. On the other, there is an undeniable and urgent need to establish clear rules and robust enforcement mechanisms to protect investors and the stability of the financial system.

The DOJ’s response to the senators’ questions will be closely watched. It may clarify whether the department believes its existing structures are sufficient to handle the crypto crime wave or if it plans to allocate resources differently. This dialogue is a crucial part of shaping the future regulatory landscape, signaling to both bad actors and legitimate businesses how seriously the United States takes enforcement in the digital asset space.

As cryptocurrency continues to mature and integrate into the global economy, the balance between innovation and enforcement remains a delicate and critically important policy issue.