Michael Saylor Reaffirms Commitment to Bitcoin Amid Market Volatility

In the ever-shifting landscape of cryptocurrency, the recent price fluctuations of Bitcoin have sparked a wave of speculation and concern among investors. However, Michael Saylor, co-founder and executive chairman of MicroStrategy, has stepped forward to clarify his company’s stance on its Bitcoin holdings. According to Saylor, MicroStrategy is not planning to sell any of its extensive Bitcoin assets but is, in fact, looking to expand its portfolio during this period of market instability.

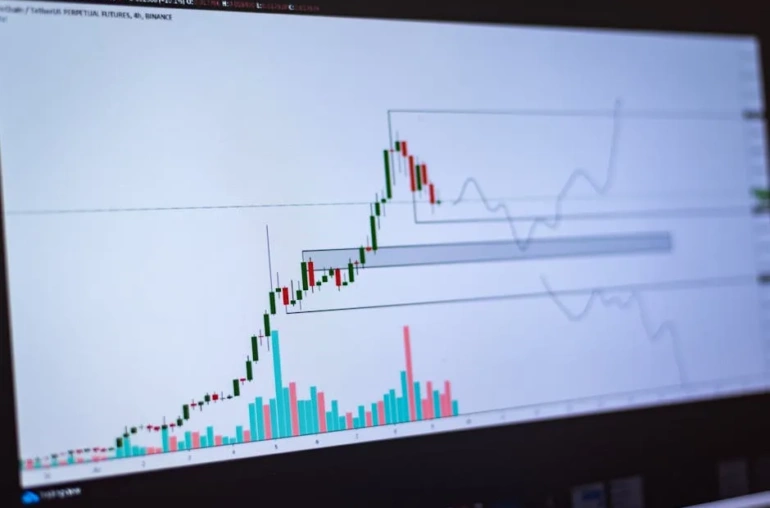

Holding Steady in a Flash Crash

Reports have circulated suggesting that MicroStrategy might be considering dumping its Bitcoin holdings, especially in light of a recent flash crash that saw the price of BTC dip significantly. However, Saylor has emphatically denied these claims, stating, “We are buying.” This statement not only reassures current investors but also highlights the company’s long-term commitment to Bitcoin as a crucial component of its financial strategy.

Building on a Strong Foundation

MicroStrategy is known for its substantial Bitcoin investments, currently holding around 640,000 BTC. This impressive accumulation positions the company as one of the largest institutional holders of Bitcoin globally. Saylor’s comments come at a time when many in the market are reassessing their strategies in response to price volatility. By continuing to purchase Bitcoin, MicroStrategy is betting on the cryptocurrency’s potential for future growth and stability.

Market Implications

The decision to buy during a downturn can be a contentious one, often leading to mixed reactions among investors. Some view it as a courageous move, showcasing confidence in Bitcoin’s long-term value, while others express caution, wary of the unpredictable nature of cryptocurrency markets. Nevertheless, Saylor’s strategy appears to be designed to leverage lower prices to enhance MicroStrategy’s already significant holdings.

A Vision for the Future

As the cryptocurrency market continues to evolve, the actions of key players like MicroStrategy can influence broader market sentiments. Saylor’s commitment to Bitcoin reflects a belief that the digital asset will play an integral role in the future of finance. By publically announcing their intent to buy more BTC, Saylor is not only defending MicroStrategy’s position but also potentially encouraging other investors to consider the long-term merits of Bitcoin.

With ongoing developments in the crypto space, it will be interesting to see how MicroStrategy’s strategy unfolds and whether other institutional players will follow suit. For now, Saylor’s firm stance amidst market turbulence underscores a significant narrative in the world of cryptocurrency: that sometimes, when the market dips, the best strategy may be to double down.

As we continue to monitor the cryptocurrency market, Saylor’s statements serve as a reminder of the resilience and steadfastness that can be found among those who believe in the transformative power of Bitcoin.