Metaplanet’s Bold Move: Transitioning from Bitcoin Accumulation to Strategic Acquisitions

In the world of cryptocurrency, strategies evolve rapidly, and one company making waves is Japan’s own Metaplanet. After months of aggressive accumulation of Bitcoin (BTC), the firm is shifting gears and looking to leverage its Bitcoin holdings for a new phase of growth. This transition marks a significant evolution in their business strategy, signaling their readiness to embark on an acquisition spree.

From Accumulation to Utilization

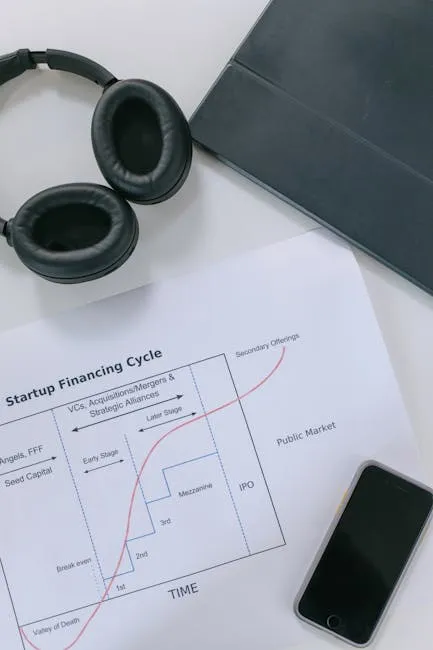

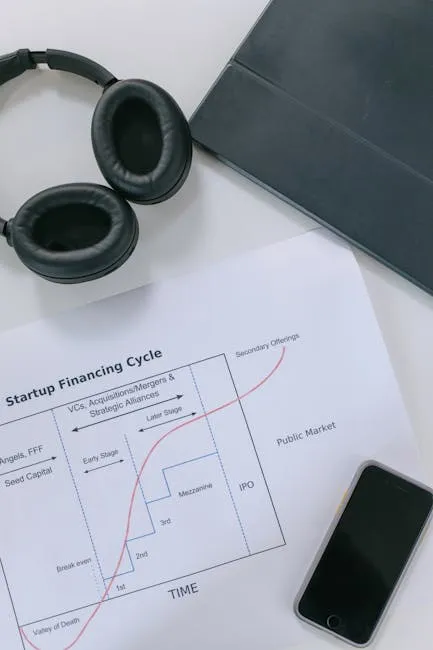

For several months, Metaplanet has focused on building a substantial Bitcoin treasury. This strategy was aimed at securing assets amidst the volatile cryptocurrency market. However, as the market landscape continues to evolve, Metaplanet is now poised to utilize these assets more strategically. Instead of merely accumulating Bitcoin, the company is preparing to use these holdings as collateral to finance acquisitions.

CEO Simon Gerovich shared insights into this strategic shift with the Financial Times, emphasizing the company’s intent to transition from accumulation to active utilization of their cryptocurrency assets. This marks a pivotal moment for Metaplanet as they look to expand their influence and capabilities within the crypto space.

A Vision for Growth

The decision to pivot towards acquisitions is driven by a vision to enhance Metaplanet’s market position. By using Bitcoin as collateral, the company aims to unlock new avenues for growth and investment. This approach not only diversifies their portfolio but also positions them to capitalize on potential opportunities in the rapidly changing financial landscape.

In a market where many companies are still grappling with the implications of cryptocurrencies, Metaplanet’s proactive strategy reflects a forward-thinking mindset. They are recognizing the value of Bitcoin not just as a speculative asset, but as a functional tool for business expansion.

The Road Ahead

As Metaplanet embarks on this new chapter, the implications for the broader cryptocurrency market are significant. The firm’s strategy could set a precedent for other companies looking to leverage their digital assets for growth. If successful, this acquisition strategy could inspire a wave of similar moves across the industry, stimulating further innovation and investment in cryptocurrencies.

Investors and industry watchers will be keenly observing how Metaplanet navigates this transition. The ability to effectively utilize Bitcoin as collateral may open doors to previously unexplored opportunities, fostering a new era of corporate adoption of cryptocurrencies.

Conclusion

Metaplanet’s shift from a Bitcoin accumulation strategy to one focused on acquisitions represents a bold and strategic move within the cryptocurrency sector. As the firm prepares to leverage its Bitcoin holdings, it sets the stage for potential growth and innovation that could resonate throughout the industry. With leaders like Simon Gerovich steering the ship, the future looks promising for Metaplanet and its stakeholders.