Navigating Bitcoin’s “Capitulation Zone”

The recent price action of Bitcoin has left many investors and traders feeling uneasy. After a period of consolidation, the leading cryptocurrency appears to be navigating what analysts are calling a “capitulation zone.” This phase is characterized by heightened selling pressure, often from long-term holders, and a series of bearish on-chain signals that suggest the market may not have found its final floor just yet. The big question on everyone’s mind is whether the $40,000 level will hold as the ultimate bottom, or if further downside is still in the cards.

Understanding Market Capitulation

Capitulation is a term used to describe a period of intense, widespread selling where investors, often out of fear or exhaustion, give up on their positions. This typically occurs after a sustained downtrend and is marked by a sharp increase in trading volume as assets are offloaded, frequently at a loss. For Bitcoin, entering this zone suggests that the market is undergoing a significant stress test. The behavior of long-term holders (LTHs)—investors who have held their coins for over 155 days—is a critical indicator. When these steadfast participants begin to sell in noticeable numbers, it often signals a potential late-stage sell-off, which can precede a market bottom.

On-Chain Metrics Paint a Bearish Picture

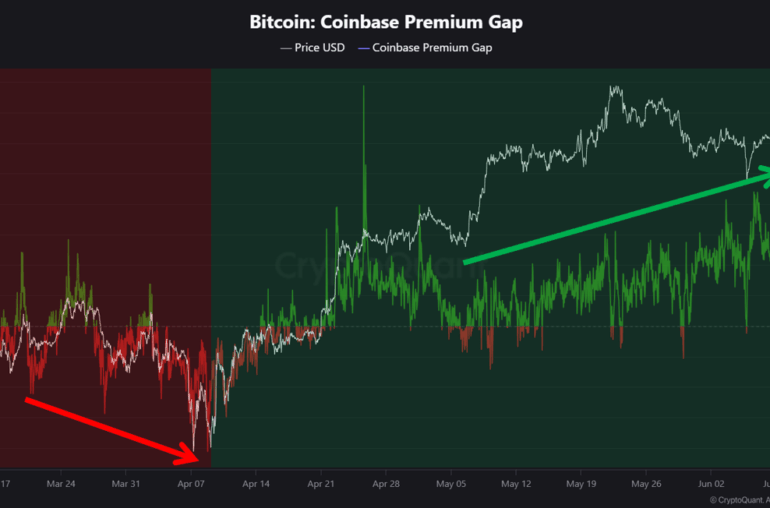

Beyond price charts, the health of the Bitcoin network is best understood through on-chain data. Several key metrics are currently flashing warning signs:

- Spent Output Profit Ratio (SOPR): This metric tracks whether coins being moved are being sold at a profit or loss. A sustained period below 1 indicates coins are being sold at a loss, a hallmark of capitulation.

- Exchange Inflows: An increase in Bitcoin being transferred to exchanges can signal an intent to sell, adding to immediate selling pressure.

- MVRV Z-Score: This compares Bitcoin’s market value to its realized value (the price at which each coin last moved). When it dips into negative territory, it historically indicates the asset is undervalued, but it can also precede further declines during extreme fear.

These data points collectively tease the possibility of further downside, creating a cautious environment for traders.

The $40,000 Question: Bottom or Bounce?

The debate among traders centers on the significance of the $40,000 support level. This psychological and technical zone has acted as both resistance and support in the past. A decisive break and hold below it could trigger another wave of selling, potentially pushing prices toward lower supports. Conversely, a strong rejection and bounce from this area could build the foundation for a recovery, convincing the market that capitulation has run its course.

Predicting the exact bottom is notoriously difficult. While capitulation phases are painful, they are also a necessary part of the market cycle, often washing out weak hands and setting the stage for the next bullish advance. For disciplined investors, these periods can present long-term accumulation opportunities, albeit with high volatility and emotional strain.

Looking Ahead with Caution

Bitcoin’s journey through this capitulation zone is a stark reminder of the cryptocurrency market’s volatility. While the on-chain data and holder behavior suggest caution is warranted, it’s crucial to maintain perspective. Market extremes in both fear and greed are temporary. For now, traders are advised to watch the $40,000 level closely, monitor on-chain flows for signs of seller exhaustion, and prepare for either a consolidation or a final flush before a potential trend reversal. As always, risk management remains the most important strategy in such uncertain conditions.