Understanding Injective Protocol’s Bullish Pennant Formation

The cryptocurrency market is known for its volatility and rapid price movements, but certain patterns can provide valuable insights for traders and investors. One such pattern currently emerging is the bullish pennant formation for Injective Protocol, a project that has recently captured attention due to its price action and strong support levels.

What is a Bullish Pennant?

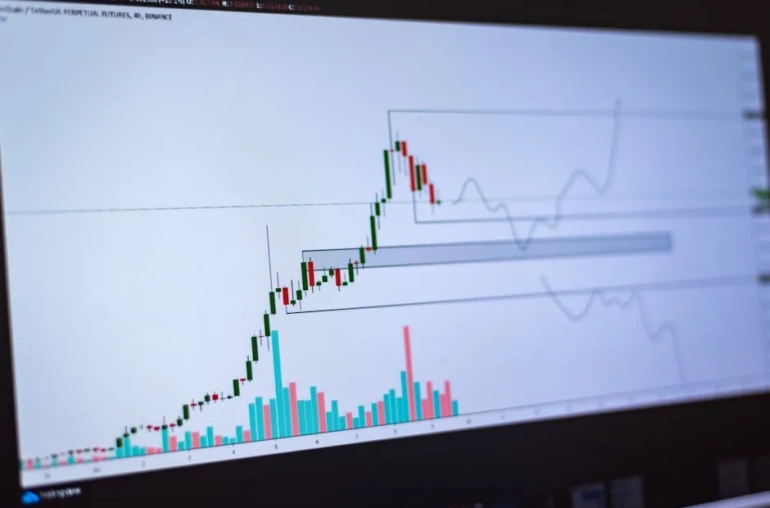

A bullish pennant is a technical chart pattern that typically indicates a continuation of an upward trend. It forms when the price consolidates within converging trend lines, creating a small symmetrical triangle. This pattern often emerges after a strong price movement, suggesting that after a period of consolidation, a breakout is imminent. In the case of Injective Protocol, the setup appears promising, with price coiling near significant high time frame support.

Current Market Conditions for Injective Protocol

Currently, Injective Protocol is trading near the value area low, a critical price zone where buying interest tends to increase. The ongoing consolidation phase indicates that investors and traders are closely monitoring this cryptocurrency for potential opportunities. As the price remains above the major support levels, the outlook appears bullish.

Potential for a Significant Rally

One of the most intriguing aspects of the current price action is the potential for a breakout supported by strong volume. Analysts suggest that a decisive move above the pennant’s upper trendline could trigger a substantial rally, with targets set as high as 150%. This projection aligns with key Fibonacci levels, which are often used by traders to identify potential reversal or breakout points in the market.

The Importance of Volume in Breakouts

Volume plays a crucial role in confirming the strength of a breakout. A surge in trading volume during the breakout would indicate strong buying interest, further validating the bullish sentiment surrounding Injective Protocol. Traders should keep a close eye on volume metrics as the price approaches the apex of the pennant.

Conclusion: A Watchful Eye on Injective Protocol

As Injective Protocol continues to coil within the bullish pennant, it presents an intriguing opportunity for traders looking to capitalize on potential price movements. With strong support holding and the possibility of a breakout backed by volume, the outlook for a 150% rally is certainly worth monitoring. As always, it’s essential to conduct thorough research and consider market conditions before making any investment decisions.

In a constantly evolving market, staying informed and strategically analyzing price patterns can help navigate the complexities of cryptocurrency trading. Keep an eye on Injective Protocol as it approaches a critical juncture in its price action.