How Improved Fiscal and Monetary Signals are Shaping a ‘Risk-On’ Quarter for Investors

As we step into the first quarter of the year, many investors are keenly observing market trends and economic signals that might influence their strategies. Recently, VanEck, a notable investment management firm, shared insights suggesting that the upcoming quarter may be characterized by a more ‘risk-on’ attitude among investors. This shift is primarily attributed to enhanced clarity regarding fiscal and monetary policies.

What Does ‘Risk-On’ Mean for Investors?

The term ‘risk-on’ refers to a market environment where investors are more willing to purchase higher-risk assets, anticipating higher returns. This behavior typically emerges when economic indicators suggest stability and growth. In contrast, a ‘risk-off’ sentiment leads investors to gravitate towards safer investments, such as bonds or cash, often in response to economic uncertainty.

Fiscal and Monetary Clarity: A Boost for Confidence

According to VanEck, the improved visibility in fiscal and monetary policies is a significant factor contributing to this optimistic outlook. With clearer guidelines from policymakers, investors can better assess potential risks and rewards in various sectors. This transparency helps reduce the anxiety that often accompanies speculative investments, encouraging a more engaged approach to market opportunities.

Investors are likely to respond positively to developments such as potential fiscal stimulus measures and interest rate decisions, which can create an environment conducive to economic expansion. The anticipation of these moves could pave the way for increased investment in growth-oriented sectors, including technology, consumer goods, and, notably, cryptocurrency.

The Bitcoin Component: Still Uncertain

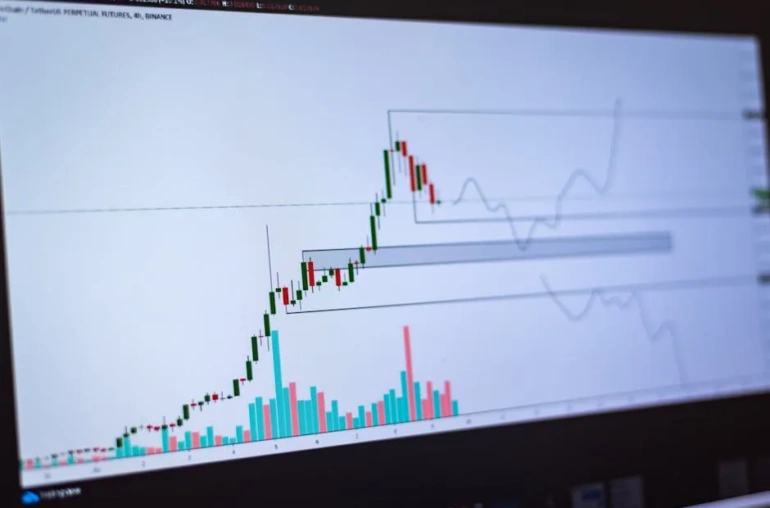

While VanEck expresses a generally optimistic view of the market, the firm acknowledges that the role of Bitcoin and other cryptocurrencies remains uncertain. Bitcoin has historically been viewed as both a high-risk asset and a potential hedge against inflation. However, its volatile nature and regulatory considerations can complicate its integration into traditional investment portfolios.

As fiscal and monetary policies evolve, the question remains: how will Bitcoin fit into the broader investment landscape? Some analysts believe that as confidence in economic stability grows, more investors might consider allocating a portion of their portfolios to Bitcoin and other cryptocurrencies. Conversely, others caution that without regulatory clarity, Bitcoin’s path may still be fraught with challenges.

Looking Ahead: What Should Investors Consider?

As we navigate the early months of the year, it’s essential for investors to stay informed about economic developments that could impact their strategies. Here are a few considerations:

- Monitor Policy Changes: Keep an eye on announcements from central banks and government agencies regarding fiscal stimulus and interest rate adjustments.

- Diversify Investments: In a ‘risk-on’ environment, consider diversifying into sectors that may benefit from economic growth.

- Evaluate Cryptocurrency Options: Assess whether including cryptocurrencies like Bitcoin aligns with your overall investment strategy and risk tolerance.

In conclusion, as VanEck suggests, the first quarter may present unique opportunities for investors ready to embrace a more confident market stance. With improved fiscal visibility and monetary clarity, the potential for a ‘risk-on’ environment could lead to innovative investment strategies and a renewed focus on growth.