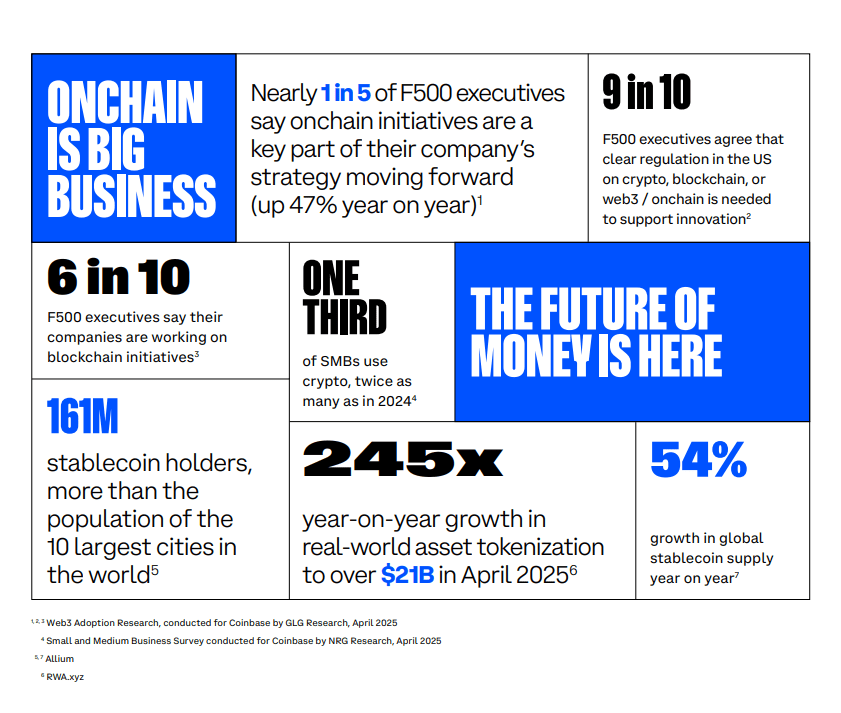

Fortune 500 Executives Are Betting Big on Stablecoins

Corporate interest in stablecoins has skyrocketed in 2025, with a staggering 300% increase in adoption among Fortune 500 executives. According to a recent study, 29% of surveyed leaders now view stablecoins as a critical financial tool—up from just 8% in 2024. This seismic shift signals a growing trust in cryptocurrency’s most predictable asset class.

Why Stablecoins Are Gaining Traction

Stablecoins, cryptocurrencies pegged to stable assets like the US dollar, offer corporations a unique blend of benefits:

- Reduced Volatility: Unlike Bitcoin or Ethereum, stablecoins minimize exposure to price swings.

- Faster Transactions: Cross-border payments settle in minutes, bypassing traditional banking delays.

- Cost Efficiency: Lower fees compared to legacy financial systems.

Smaller Firms Are Following Suit

The trend isn’t limited to Fortune 500 giants. Mid-sized and smaller companies are also exploring stablecoins for treasury management and B2B payments. Analysts attribute this to:

- Improved regulatory clarity (e.g., MiCA in the EU).

- Integration with enterprise blockchain solutions.

- Success stories from early adopters like MicroStrategy and Tesla.

Challenges Ahead

Despite the enthusiasm, hurdles remain. Executives cited concerns about:

- Regulatory Uncertainty: Evolving policies could impact adoption.

- Security Risks: High-profile crypto breaches have heightened caution.

- Liquidity Management: Ensuring seamless conversion to fiat.

The Bottom Line

Stablecoins are no longer a niche experiment—they’re becoming a cornerstone of corporate finance. As Fortune 500 companies lead the charge, the ripple effect could redefine global transactions. For businesses still on the fence, the message is clear: the time to evaluate stablecoins is now.

Also Read: How Blockchain Is Reshaping Fortune 500 Supply Chains