The Fed’s Call for a New Approach to Crypto Risk

A new paper from the Federal Reserve is making waves in the financial world, arguing that traditional financial safeguards are ill-equipped to handle the unique challenges posed by cryptocurrencies. The core message is clear: the extreme volatility and distinct market behavior of crypto assets require a fundamentally different regulatory approach, especially when it comes to derivatives.

Why Old Models Don’t Fit New Assets

For decades, banks and regulators have relied on established risk-weightings and financial models to determine how much capital should be held against potential losses. These models are built on historical data from traditional markets like stocks and bonds. According to the Fed researchers, these tried-and-true methods simply fall short when applied to crypto.

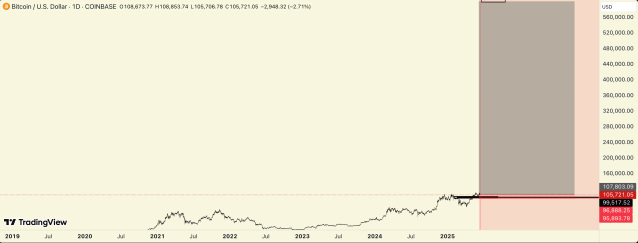

The primary issue is volatility. Cryptocurrencies can experience price swings that are orders of magnitude greater than those seen in conventional markets. A model calibrated for the S&P 500 would be dangerously inaccurate for Bitcoin or Ethereum. Furthermore, crypto markets can behave in unexpected ways, with correlations between assets shifting rapidly and liquidity drying up in times of stress—phenomena that traditional risk assessments struggle to capture.

The Proposal: Initial Margin Weights

In response to this gap, the paper proposes a specific regulatory tool: initial margin requirements for crypto-linked derivatives. In simple terms, “initial margin” is the collateral that parties in a derivatives contract must post upfront to cover potential future losses.

The Fed’s suggestion is to apply specific, and likely higher, margin weights to crypto derivatives. This means institutions trading these instruments would need to set aside more capital as a buffer. The goal is to create a stronger financial cushion that can absorb the shocks inherent to the crypto market, thereby protecting both the trading parties and the broader financial system from contagion.

What This Means for the Crypto Market

This proposal is a significant step in the formal integration—and regulation—of cryptocurrency into the mainstream financial system. It acknowledges that crypto is here to stay as an asset class but recognizes its distinctive risks.

For institutional investors and banks, higher margin requirements could increase the cost of trading crypto derivatives, potentially dampening some activity but also promoting greater stability. For the market overall, it represents a move toward more mature, risk-aware frameworks. Regulators are signaling that they will not force a square peg (crypto) into a round hole (traditional finance), but will instead develop new rules tailored to its reality.

As the dialogue between innovators and regulators continues, proposals like this one from the Federal Reserve will be crucial in shaping a secure and sustainable future for digital asset markets.