Ethereum Whales Make a Comeback: What It Means for the Market

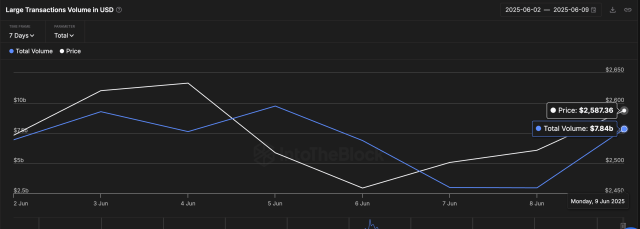

After weeks of subdued activity, Ethereum whales are back in action—and they’re making waves. Recent data reveals a staggering 100% increase in large ETH transactions within just 24 hours, signaling renewed confidence among deep-pocketed investors. This surge comes as Ethereum’s price shows signs of recovery, sparking speculation about a potential altcoin season.

Why Are Whales Suddenly Active?

Ethereum’s recent price rebound appears to be the catalyst. After enduring significant sell-offs, ETH has stabilized, attracting institutional and high-net-worth investors. Key factors driving this shift include:

- Market Sentiment Improvement: Broader crypto optimism is returning, with Bitcoin leading the charge.

- DeFi and NFT Revival: Ethereum’s ecosystem is seeing renewed interest in decentralized applications.

- Upcoming Upgrades: Anticipation around Ethereum’s next protocol improvements may be fueling accumulation.

Could This Trigger an Altcoin Season?

Historically, Ethereum whale movements have preceded altcoin rallies. When large investors accumulate ETH, liquidity often trickles down to smaller-cap tokens. Here’s what to watch for:

- ETH Dominance: A sustained rise in Ethereum’s market share could signal altcoin momentum.

- Exchange Inflows/Outflows: Whales moving ETH off exchanges suggests long-term holding.

- DeFi TVL Growth: Increasing Total Value Locked in DeFi projects often accompanies altcoin surges.

What’s Next for Ethereum and Altcoins?

While the spike in whale activity is bullish, caution is warranted. Market conditions remain volatile, and macroeconomic factors (like interest rates and regulations) could dampen momentum. Traders should monitor:

- Support Levels: ETH holding above $3,500 could confirm bullish sentiment.

- Whale Cluster Zones: Large buy/sell orders may indicate future price pivots.

- Altcoin Correlations: Tokens like Solana (SOL) and Cardano (ADA) often follow ETH’s lead.

For now, Ethereum’s resurgence is a story of big players betting big—and the altcoin market could be the next domino to fall.