Dubai’s Role in the Rising Trend of Real-World Assets: A Closer Look

As the world continues to evolve towards a digital economy, Dubai stands out as a beacon of innovation and growth, particularly in the domain of Real-World Assets (RWA). With a clear regulatory framework, strong government support, and an increasing global demand for high-yield property, it’s no surprise that Dubai is leading the charge in the RWA revolution.

Understanding Real-World Assets (RWA)

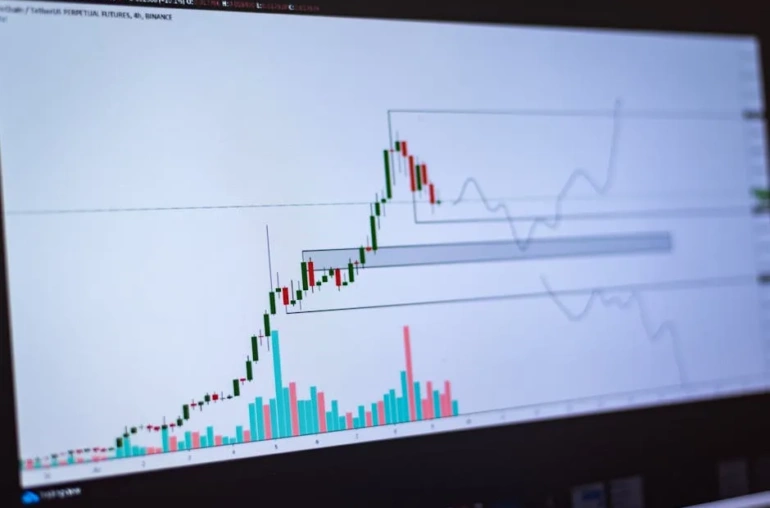

Real-World Assets refer to physical assets that can be tokenized and represented on the blockchain. This includes everything from real estate and commodities to art and collectibles. The concept of RWAs bridges the gap between traditional finance and the burgeoning world of cryptocurrencies, allowing for enhanced liquidity, transparency, and accessibility.

Dubai’s Regulatory Framework

One of the key factors propelling Dubai into the forefront of the RWA market is its robust regulatory environment. The Dubai Financial Services Authority (DFSA) has established comprehensive guidelines that govern the use of blockchain technology and the tokenization of assets. These regulations not only enhance investor confidence but also attract global players looking to tap into Dubai’s vibrant economy.

Government Backing and Support

Dubai’s government has been proactive in fostering an ecosystem conducive to innovation. Initiatives such as the Dubai Blockchain Strategy aim to make Dubai a global blockchain hub by 2020, promoting the integration of blockchain technology across various sectors. This governmental backing provides a solid foundation for businesses and investors alike, encouraging the growth of RWAs.

The Demand for High-Yield Property

Dubai’s real estate market has long been attractive to investors due to its high yield potential. With luxury developments, commercial spaces, and residential properties offering lucrative returns, the appetite for investment is strong. Tokenizing these properties allows investors from around the globe to participate in the market without the barriers typically associated with real estate investment.

Smart Contracts: The Future of Transactions

At the heart of the RWA revolution is the concept of smart contracts. These self-executing contracts, with the agreement directly written into code, streamline transactions and reduce the need for intermediaries. In Dubai, the integration of smart contracts into real estate transactions is gaining traction, enabling quicker, more secure, and transparent dealings.

The Path Forward

As Dubai continues to innovate and adapt, the potential for RWAs is boundless. With its unique combination of regulatory support, government initiatives, and a thriving real estate market, the city is well-positioned to be a leader in this evolving landscape. Investors and businesses alike should watch closely as Dubai solidifies its role at the forefront of the RWA revolution.

In conclusion, the convergence of technology, regulation, and real estate in Dubai offers a glimpse into the future of investing. As the demand for RWAs grows, so too will the opportunities within this exciting new frontier.