Crypto Stocks Take a Hit: Analyzing the Impact of Macro Economic Factors

It has been a challenging week for cryptocurrency stocks, with prominent players like Coinbase, Block, and Robinhood experiencing significant declines. A confluence of macroeconomic fears, concerns surrounding a potential government shutdown, and the aftershocks of October’s staggering $19 billion liquidation have contributed to a soured investor sentiment in the crypto market.

Understanding the Current Landscape

The cryptocurrency market is no stranger to volatility, but recent events have heightened the uncertainty for investors. The fear surrounding macroeconomic factors, including inflation rates and interest rate hikes, has led to cautious trading behavior. Investors are understandably skittish, opting to sideline their investments in the face of potential economic downturns.

Government Shutdown Jitters

Adding to this precarious situation is the looming threat of a government shutdown. The prospect of a stalled government can create ripples across various markets, including cryptocurrencies. Investors are worried about the implications of halted government functions, which could lead to regulatory delays or uncertainties affecting blockchain technology and digital currencies.

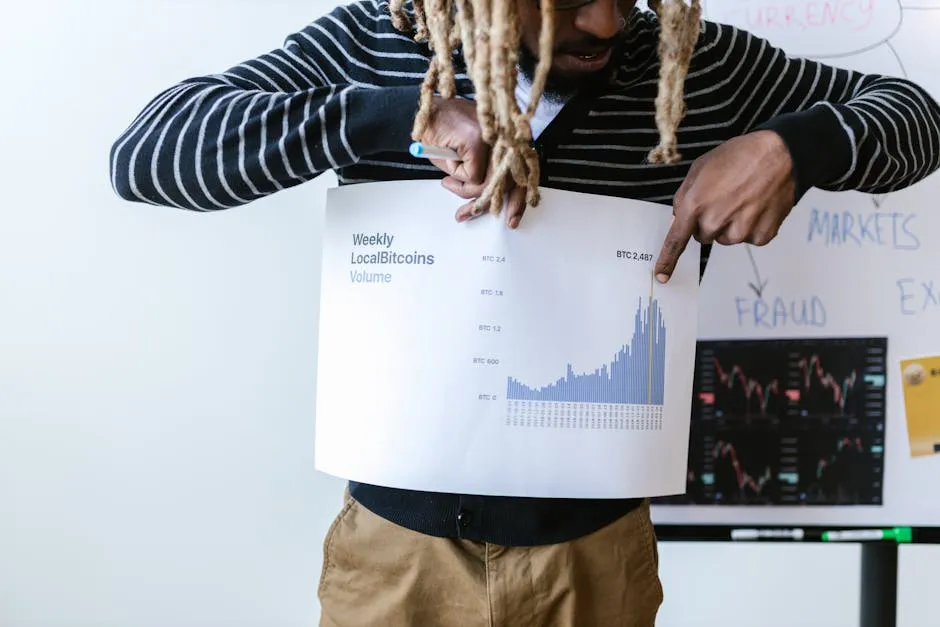

The Fallout from October’s Liquidation

In October, the market witnessed a massive liquidation event amounting to $19 billion. This incident not only shook investor confidence but also served as a stark reminder of the inherent risks associated with crypto trading. As the market attempts to recover, the impact of this liquidation continues to loom large, casting a shadow over potential growth and stability.

What This Means for Investors

For investors navigating this tumultuous landscape, the key takeaway is the importance of staying informed and vigilant. Understanding macroeconomic trends, regulatory news, and market sentiment can help in making more informed decisions. Diversifying one’s portfolio and considering risk tolerance levels are also crucial strategies in these uncertain times.

Looking Ahead

While the current scenario may seem bleak, the crypto market is known for its resilience. Historically, it has bounced back from downturns, often emerging stronger. As new developments unfold, investors will need to keep a close eye on both macroeconomic indicators and the evolving landscape of cryptocurrency regulation.

In conclusion, while the week may have been dismal for crypto stocks, understanding the underlying factors at play can help investors navigate these choppy waters. Staying informed, diversifying investments, and maintaining a long-term perspective may be the best strategies moving forward.