The Setup for a “Revenge Rally” in Bitcoin

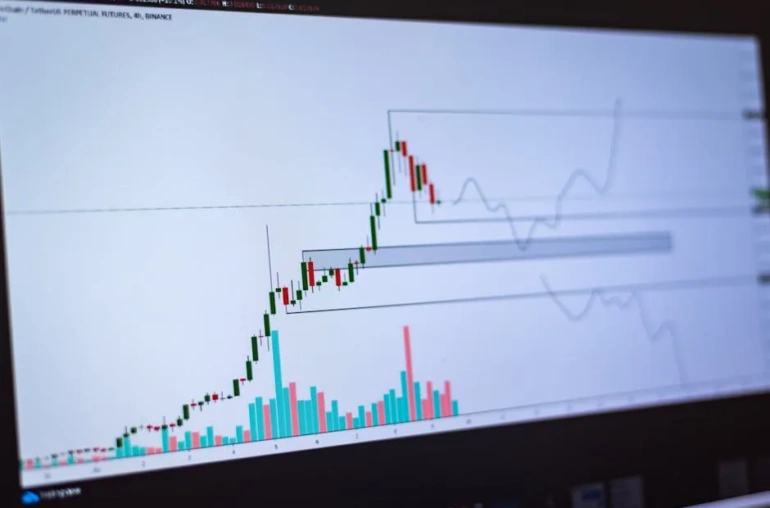

As Bitcoin’s price recently dipped toward the $81,000 mark, a fascinating and potentially volatile dynamic began playing out behind the scenes in the derivatives market. A significant number of traders placed bets against the world’s leading cryptocurrency, piling up short positions in anticipation of further declines. However, this very buildup of pessimism might be setting the stage for a powerful counter-move—a so-called “revenge rally” that could propel BTC back above $90,000.

Understanding the Liquidation Fuel

In the high-stakes world of cryptocurrency futures trading, positions are often taken with leverage. This means traders borrow funds to amplify their potential gains (or losses). When the market moves against these leveraged positions, exchanges automatically close, or “liquidate,” them to prevent further losses. This process can create cascading buy or sell orders that accelerate price movements.

The current situation suggests a large cluster of leveraged short positions now sits precariously close to Bitcoin’s current price. If BTC begins to climb instead of fall, these shorts will start getting liquidated. Each liquidation triggers a market buy order to close the position, which in turn pushes the price higher, potentially triggering more liquidations in a self-reinforcing cycle.

From Market Imbalance to Price Momentum

This scenario is often referred to as a “short squeeze.” When too many traders are positioned for a price drop, even a modest upward move can force them to buy back Bitcoin to cover their bets, creating intense buying pressure. The recent accumulation of shorts has created a notable imbalance. This imbalance isn’t just a theoretical risk; it represents tangible fuel for a rapid price increase if the market sentiment shifts.

Analysts monitoring futures data see this setup as a potential catalyst. The market, in its attempt to correct the overabundance of one-sided bets, can move violently in the opposite direction. In this case, the path of least resistance for liquidating these crowded short positions points upward, with key liquidation levels clustered around the path to $90,000.

What Traders Should Watch For

For investors and traders, this highlights the importance of looking beyond simple price charts. Derivatives market data, including funding rates and the concentration of long and short positions, can provide crucial context for potential volatility.

- Monitor Price Levels: A sustained move above key resistance levels could be the initial spark that triggers the liquidation cascade.

- Watch Futures Data: Keep an eye on metrics like estimated liquidation levels and open interest to gauge market crowding.

- Manage Risk: Periods of high leverage imbalance often lead to increased volatility. Ensuring appropriate risk management is essential.

While past performance is no guarantee, the mechanics of leveraged futures markets provide a clear blueprint for how rapid rallies can occur. The pile-up of Bitcoin shorts may have inadvertently laid the groundwork for its next significant surge, turning bearish bets into the very engine for a bullish “revenge” move.