Coinbase’s Bullish 2025 Crypto Outlook: What You Need to Know

The cryptocurrency market could be gearing up for a significant surge in 2025, according to a new report from Coinbase Institutional. Authored by David Duong, Global Head of Research, the analysis highlights a combination of macroeconomic tailwinds, clearer regulations, and growing corporate adoption as key drivers. However, the report also warns that excessive leverage could pose a hidden risk to this optimistic forecast.

Why 2025 Could Be a Breakout Year for Crypto

Coinbase’s research identifies three major factors fueling the potential 2025 rally:

- Macroeconomic Trends: Lower interest rates and inflation control could revive risk appetite among investors.

- Regulatory Clarity: Progress in frameworks like MiCA (EU) and the GENIUS Act (US) may reduce uncertainty.

- Corporate Adoption: More Fortune 500 companies are expected to integrate blockchain solutions or hold crypto assets.

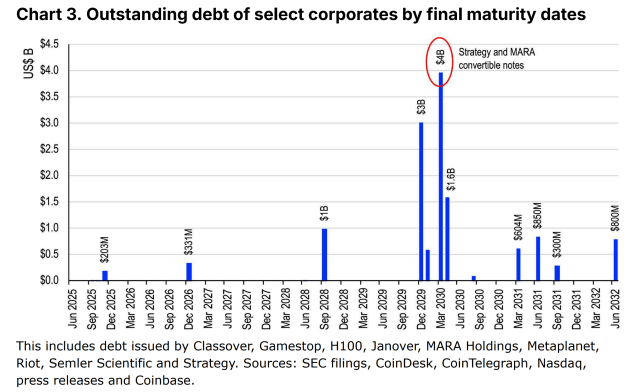

The Leverage Problem: A Potential Time Bomb

While the outlook is largely positive, Coinbase cautions that high leverage in crypto trading could amplify volatility. Derivatives markets, where traders often use borrowed funds to magnify gains (or losses), might trigger cascading liquidations if sentiment shifts abruptly. The report suggests that investors should:

- Monitor open interest in futures markets.

- Diversify holdings to mitigate sudden downturns.

- Avoid overexposure to highly leveraged positions.

Institutional Interest: A Double-Edged Sword

Growing institutional involvement—evidenced by Bitcoin ETF approvals and firms like MicroStrategy’s continued accumulation—could stabilize the market long-term. However, Coinbase notes that institutional flows might also introduce new volatility patterns, as large players react swiftly to macroeconomic data.

Key Takeaways for Investors

For those planning their 2025 crypto strategy, the report emphasizes:

- Focus on fundamentals: Projects with real-world utility (DeFi, tokenized assets) may outperform speculative bets.

- Stay adaptable: Regulatory shifts and geopolitical events could alter trajectories.

- Risk management is critical: Leverage can turbocharge gains but also lead to steep losses.

As the crypto landscape evolves, Coinbase’s analysis serves as both a roadmap and a warning: the 2025 surge could be monumental, but only for those who navigate its risks wisely.