Brazil’s Largest Private Bank Recommends 3% Bitcoin Allocation for 2026

In a notable shift for traditional finance, Brazil’s largest private bank has made a bold recommendation for investors looking to enhance their portfolios in the coming years. According to Itau Asset Management, allocating 3% of investment portfolios to Bitcoin could be a strategic move by 2026. This advice comes despite the cryptocurrency’s tumultuous performance in recent times.

Understanding the Recommendation

The suggestion to invest in Bitcoin is grounded in the asset’s potential for improving portfolio diversification. Itau Asset believes that including cryptocurrency in investment strategies can act as a hedge against currency risk, which is particularly relevant in today’s economic climate marked by uncertainty and volatility.

Bitcoin, often dubbed digital gold, has shown a unique ability to move independently of traditional assets. This characteristic makes it an attractive option for investors seeking to minimize risk while maximizing potential returns. The bank’s analysts argue that as Bitcoin continues to mature, its role in investment portfolios will only become more significant.

Why 3%?

The 3% allocation proposed by Itau Asset is not arbitrary; it reflects a calculated approach toward integrating Bitcoin into a diversified investment strategy. This percentage allows investors to benefit from Bitcoin’s growth potential while limiting exposure to its inherent volatility. By maintaining a small, controlled investment in cryptocurrency, investors can navigate the ups and downs of the market without jeopardizing their overall portfolio.

Current Market Conditions

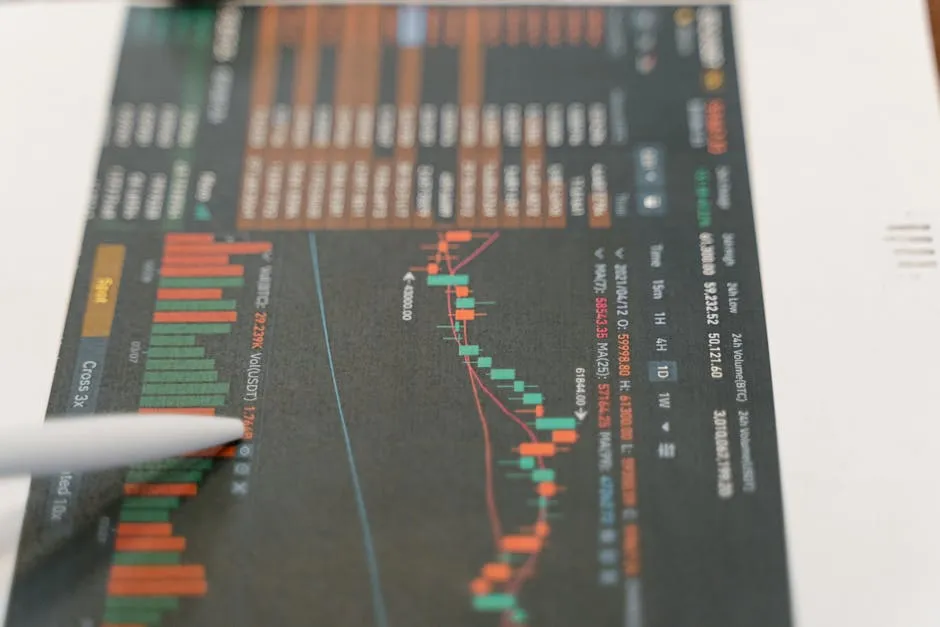

The announcement comes at a time when Bitcoin and the broader cryptocurrency market have experienced significant fluctuations. While some investors remain cautious, many financial institutions are beginning to recognize the importance of including digital assets as part of a balanced investment approach. Itau Asset’s endorsement could pave the way for other banks and investment firms to follow suit, potentially normalizing Bitcoin as a key component of investment portfolios.

The Future of Bitcoin Investments

Looking ahead, the integration of Bitcoin into mainstream financial advice signals a shift in how cryptocurrencies are perceived. As more institutions begin to advocate for digital assets, the narrative surrounding Bitcoin is likely to change from speculative asset to essential investment tool.

In conclusion, Itau Asset Management’s recommendation for a 3% Bitcoin allocation by 2026 is a significant endorsement of cryptocurrency’s viability in investment strategies. For investors, this could represent an opportunity to enhance their portfolios, hedge against currency risks, and embrace the future of finance.