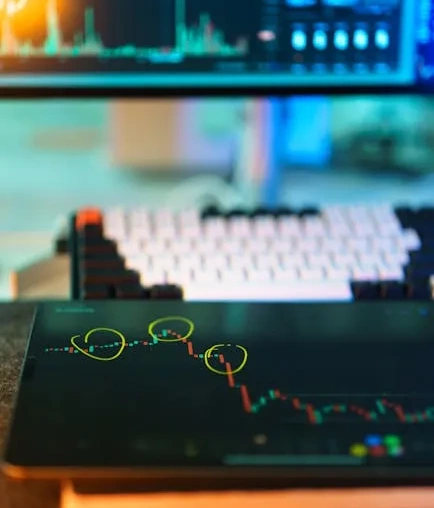

Bitcoin’s Rally Hits a Wall at $98,000

The recent surge in Bitcoin’s price has hit a significant roadblock. After a strong push towards the $98,000 mark, the leading cryptocurrency faced a sharp rejection, leaving traders to wonder about the next move. This pullback wasn’t a random event; it was driven by a clear shift in market dynamics as short-term momentum faded and profit-taking kicked in.

Why Did Bitcoin Stall?

The climb towards $98,000 was fueled by spot market buying—traders purchasing actual Bitcoin with the expectation of holding it. However, this buying pressure appears to have run out of steam. At the same time, a wave of profit-taking from short-term investors who bought at lower levels created selling pressure. This combination allowed bears (traders betting on a price drop) to successfully defend this key psychological and technical resistance level.

This creates a classic standoff. The bulls need to gather enough sustained buying volume to break through the selling wall. The bears, on the other hand, are aiming to turn this resistance into a ceiling that pushes the price lower, potentially triggering a deeper correction.

The Crucial Weekend Test

All eyes are now on whether the bears can maintain their defense throughout the weekend. Weekend trading sessions are often characterized by lower liquidity, which can lead to increased volatility. Sharp price swings in either direction become more likely when there are fewer major market participants active.

If Bitcoin’s price consolidates below $98,000 without breaking down significantly, it could indicate that the bulls are regrouping for another attempt. A strong close above this level would be a major bullish signal, potentially opening the door to a test of the next major milestone. Conversely, a failure to hold support could see the price retreat to find a new base from which to launch another attack.

What Traders Are Watching

For traders and investors, this moment is critical. Key factors to monitor include:

- Volume: Is there a surge in buying volume to support a breakout, or is selling volume dominating?

- Market Sentiment: Shifts in trader sentiment on derivatives platforms can provide clues about market expectations.

- Broader Market Conditions: Movements in traditional markets or major news events can also influence crypto asset prices.

The battle for $98,000 is more than just a number; it’s a test of current market conviction. The outcome will likely set the tone for Bitcoin’s trajectory in the near term, making this a weekend to watch the charts closely.