Bitcoin’s Unstoppable Surge: How Long-Term Holders Are Rewriting Market History

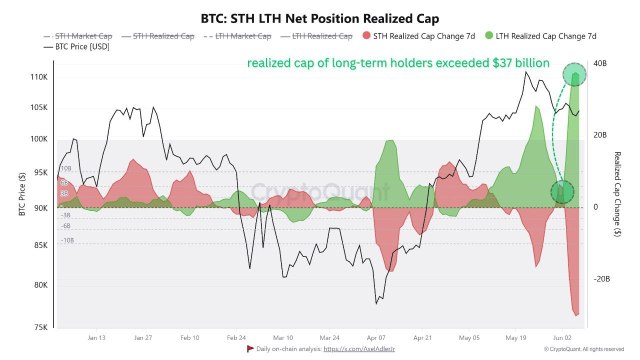

As Bitcoin reclaims its bullish momentum, crossing the $106,000 threshold, long-term holders (LTHs) are emerging as the unsung heroes of this rally. Their unwavering confidence is reflected in the soaring realized capitalization, a metric that tracks the aggregate cost basis of coins moved on-chain. This unprecedented climb signals a seismic shift in market dynamics—one where patient investors are reaping historic rewards.

Why Realized Cap Matters More Than Ever

Unlike market cap, which fluctuates with price, realized cap measures the “true” value of Bitcoin by accounting for the price at which each coin last changed hands. The recent surge suggests:

- Strong accumulation: LTHs are holding tighter than ever, reducing sell-side pressure.

- Higher cost bases: New buyers are entering at elevated prices, signaling conviction.

- Market maturation: Fewer speculative trades and more strategic holding.

The Psychology Behind the Hold

What’s driving this diamond-handed behavior? Analysts point to three key factors:

- Institutional validation: Bitcoin ETFs and corporate treasuries (like MicroStrategy) have normalized long-term ownership.

- Macro uncertainty: With inflation lingering, BTC remains a hedge for savvy investors.

- Technical milestones: Breaking all-time highs reinforces the “hold” mentality.

What This Means for the Market

As LTHs lock up supply, the stage is set for amplified volatility—but with a bullish bias. Historical data shows that when realized cap enters uncharted territory, it often precedes:

- Extended price discovery phases

- Fewer panic sell-offs during corrections

- Stronger support levels

“This isn’t just a rally—it’s a fundamental rewiring of Bitcoin’s value proposition,” notes Kyle Doops, whose chart (above) highlights the correlation between LTH activity and price resilience.

The Bottom Line

While short-term traders chase peaks, long-term Bitcoin holders are quietly building the foundation for the next cycle. Their growing realized cap isn’t just a metric—it’s a testament to the asset’s evolution from speculative gamble to store of value. As the market watches $106,000, the real story unfolds in the wallets of those who’ve seen—and held—through it all.