Beyond Easy Money: Bitcoin’s Next Bull Run

For years, a common narrative in the cryptocurrency space has linked Bitcoin’s price surges to periods of loose monetary policy. When central banks, like the U.S. Federal Reserve, cut interest rates and inject liquidity into the economy, risk assets like Bitcoin have historically flourished. But what if the next major bull market doesn’t come from that familiar playbook?

According to Jeff Park, a seasoned crypto executive, Bitcoin reaching a state where its price appreciates consistently even as the Federal Reserve is hiking interest rates would represent the asset’s “endgame.” This perspective challenges the conventional wisdom and points to a more mature future for the flagship cryptocurrency.

The Traditional Catalyst vs. The “Endgame”

The traditional model is straightforward. “Accommodative policies”—low interest rates and quantitative easing—make holding cash less attractive and push investors toward higher-yielding, albeit riskier, assets. This environment has been a fertile ground for Bitcoin’s growth.

Park’s “endgame” scenario flips this on its head. It suggests a future where Bitcoin’s value proposition is so strong and widely recognized that it decouples from this macro dependency. In this world, Bitcoin would be sought after not as a speculative hedge against loose policy, but for its core properties—scarcity, decentralization, and utility as a digital store of value—regardless of the interest rate environment.

What Would This Decoupling Mean?

If Bitcoin can thrive during monetary tightening, it would signal a profound shift in its market perception. It would move from being viewed primarily as a risk-on, speculative asset to being acknowledged as a legitimate, uncorrelated asset class with unique fundamentals.

This transition wouldn’t happen overnight. It would likely require broader institutional adoption, clearer regulatory frameworks, and the continued development of real-world utility beyond pure speculation. The network effect would need to reach a critical mass where demand is driven by its inherent technology and economic model, not just by the search for yield in a low-rate world.

The Road Ahead for Investors

For investors, this concept is a crucial lens for evaluating Bitcoin’s long-term trajectory. While short-term price action may still react to Fed announcements and macroeconomic data, the true measure of Bitcoin’s success will be its performance across all phases of the economic cycle.

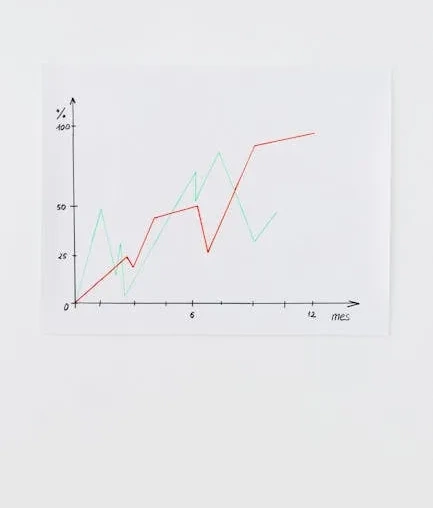

Watching how Bitcoin behaves during periods of sustained high interest rates will be the ultimate test. A pattern of resilience and growth in such conditions would be the strongest evidence yet that Bitcoin has graduated to its promised role as “digital gold,” an asset that stands on its own merits, independent of central bank policies.

The journey to this “endgame” may be volatile, but it represents the final frontier for Bitcoin’s acceptance as a foundational pillar of the global financial system.