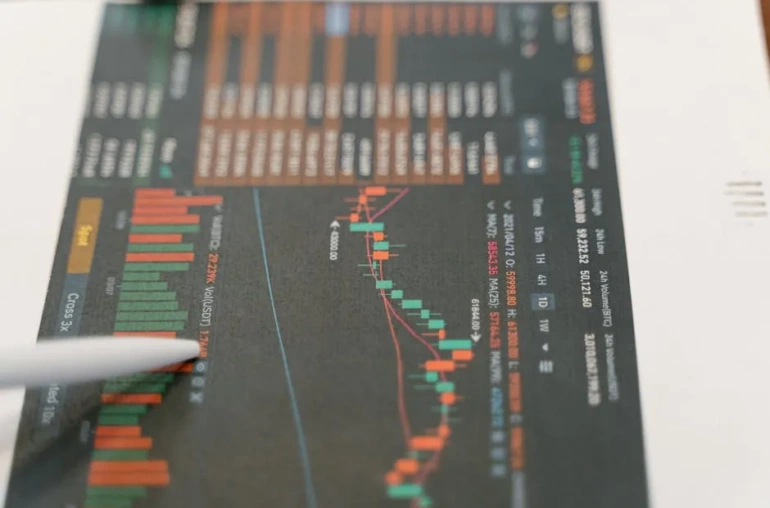

Bitcoin’s Battle at the $70,000 Ceiling

Bitcoin’s recent attempts to decisively break above the psychologically significant $70,000 level have been met with consistent resistance. As of late, the leading cryptocurrency has remained pinned below this key threshold, with market analysts pointing to a confluence of factors applying downward pressure. Beyond the immediate price action, a subtle but critical signal from the derivatives market is flashing a warning sign: Bitcoin’s funding rate has turned negative.

Understanding the Funding Rate Warning Signal

For those less familiar with crypto market mechanics, the funding rate is a periodic payment exchanged between traders in perpetual futures contracts. Its purpose is to tether the price of the perpetual contract to the underlying spot price. A positive funding rate indicates that traders are predominantly bullish, with longs paying shorts to maintain their positions. Conversely, a negative funding rate suggests a bearish tilt, where short sellers are compensating long holders.

The shift to a negative funding rate for Bitcoin is significant. It signals that sentiment among leveraged derivatives traders is cooling, or even turning cautious, after a prolonged period of optimism. This can often precede or accompany a period of price consolidation or correction, as excessive bullish leverage is unwound.

Broader Market Pressures at Play

The warning from the derivatives market isn’t occurring in a vacuum. External pressures are also weighing on Bitcoin and the broader digital asset space. A notable factor is the cooling trend within the U.S. technology sector. As tech stocks, often seen as a risk-on bellwether similar to crypto, experience volatility or pullbacks, it can dampen investor appetite for speculative assets like Bitcoin. This interconnectedness means that macroeconomic sentiment and traditional market movements continue to have a pronounced impact on cryptocurrency valuations.

This combination—internal market caution reflected in the funding rate and external pressure from traditional finance—creates a challenging environment for a sustained bullish breakout.

What This Means for Traders and Investors

For market participants, the current setup calls for heightened awareness. A negative funding rate alone is not a definitive predictor of a major crash, but it is a clear indicator of shifting short-term sentiment and positioning. It often leads to increased market volatility as positions are rebalanced.

Long-term investors might view periods of consolidation and negative sentiment as potential accumulation opportunities, especially if their conviction in Bitcoin’s fundamental thesis remains unchanged. However, short-term traders and those using leverage should exercise caution, as the market appears to be in a delicate state of equilibrium, searching for the next catalyst to determine its direction.

The key level to watch remains the $70,000 resistance. A convincing break and hold above it, potentially accompanied by a return to a neutral or positive funding rate, could reignite bullish momentum. Until then, the market signals suggest patience is warranted as Bitcoin navigates this period of uncertainty.