Bitcoin’s Price Trend: Analyzing the Potential $100k Crash Amid New Buying Strategies

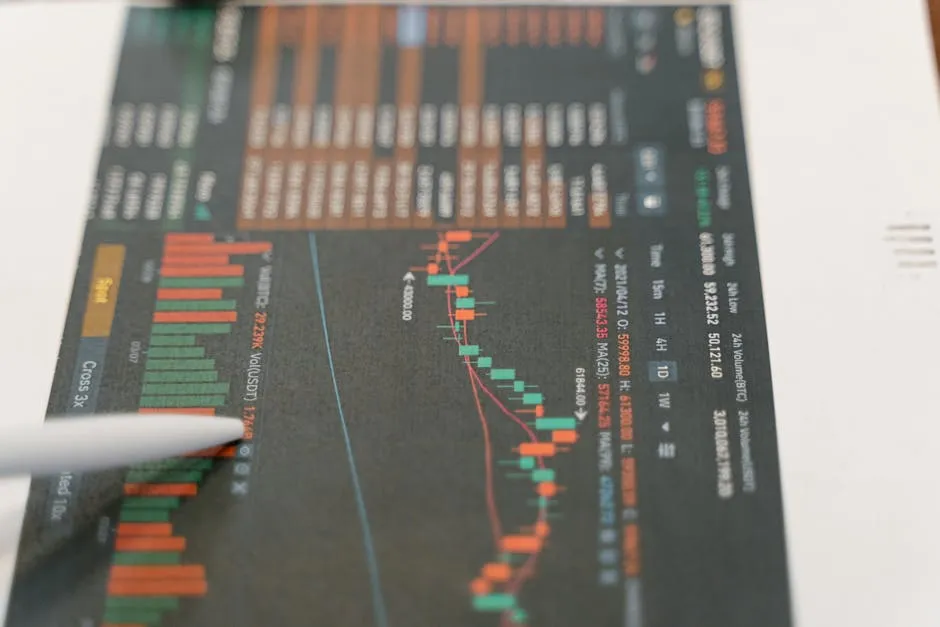

As the cryptocurrency market continues to evolve, Bitcoin is once again in the spotlight, facing potential price fluctuations that could lead to a significant downturn. Recent developments indicate that Bitcoin has slipped below both the 100-day and 50-day Exponential Moving Averages (EMAs), raising concerns among investors and analysts alike. With the Average Directional Index (ADX) rising to 19, the market is poised for critical movements that warrant close attention.

Understanding the Current Market Dynamics

Bitcoin’s recent performance has been a topic of discussion, particularly as it trades beneath key moving averages. The 100-day EMA and the 50-day EMA are essential indicators that many traders use to assess market trends. When a cryptocurrency falls below these averages, it often signals bearish sentiment and can lead to further price decline.

The rise of the Average Directional Index (ADX) to 19 indicates that the market is experiencing increased momentum, albeit not yet strong enough to suggest a definitive trend. This situation creates a cautious atmosphere, as traders and investors weigh their options in light of potential volatility.

Convano’s New Buying Strategy

Adding to the intrigue in the market is Convano’s recent adoption of a Metaplanet-style buying strategy. This approach is designed to capitalize on market movements and trends, potentially positioning Convano to take advantage of price fluctuations effectively. The strategy’s emphasis on timing and market analysis could play a crucial role in how Bitcoin’s price evolves in the coming weeks and months.

What Does This Mean for Investors?

The prospect of a $100k crash in Bitcoin’s price is certainly alarming. For investors, it’s vital to stay vigilant and informed. Understanding market signals and adopting sound trading strategies can make a significant difference in navigating these turbulent waters. The combination of technical indicators and new market strategies like that of Convano offers a unique lens through which to view potential investment opportunities.

Conclusion

As we move forward, the Bitcoin market remains unpredictable. With the recent decline below critical moving averages and the introduction of innovative buying strategies like Convano’s, investors must keep a close eye on these developments. The possibility of a price crash towards $100k could serve as a wake-up call for many, prompting a reevaluation of investment strategies in the ever-changing landscape of cryptocurrency.