Bitcoin’s Price Strength vs. SOPR Decline: What’s Happening?

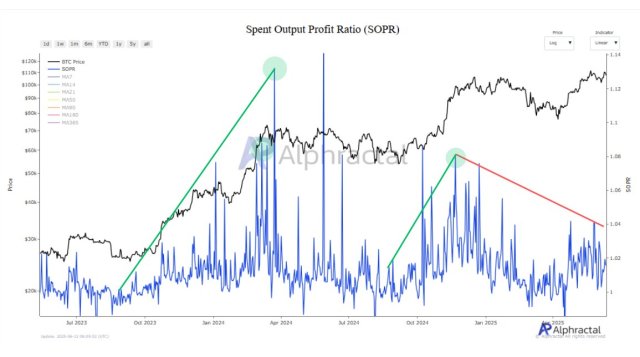

Bitcoin (BTC) has been on a tear recently, holding firm above the $100,000 mark despite multiple pullback attempts. Yet, while the price action looks bullish, a key on-chain metric—the Spent Output Profit Ratio (SOPR)—has been trending downward. This divergence raises questions: Is the rally sustainable, or is a correction looming?

Understanding the SOPR Indicator

The SOPR measures whether Bitcoin holders are selling at a profit or loss. A value above 1 indicates profit-taking, while below 1 suggests losses. Historically, a rising SOPR aligns with bullish sentiment, while a decline can signal caution. Currently, the SOPR’s drop contrasts sharply with BTC’s price surge—a rare but critical scenario.

Why the Divergence Matters

Here’s what this paradox could mean:

- Long-Term Holders Are Staying Put: The SOPR decline may reflect reduced selling by long-term investors, who are waiting for higher prices before cashing out.

- New Buyers Driving the Rally: Fresh capital entering the market could be propping up prices, even as older hands avoid profit-taking.

- Potential Overheating: If SOPR continues falling while prices rise, it might indicate speculative froth, increasing the risk of a sharp pullback.

Historical Context and Market Sentiment

Similar SOPR-price divergences have occurred in past cycles. For example, during the 2021 bull run, a declining SOPR preceded a consolidation phase. However, Bitcoin’s resilience this time—bolstered by institutional demand and ETF inflows—could rewrite the script.

What Traders Should Watch

Key signals to monitor:

- SOPR Reversal: A rebound in SOPR could confirm renewed profit-taking and validate the uptrend.

- On-Chain Support Levels: Watch for clusters of unspent transaction outputs (UTXOs) near current prices, indicating strong holder conviction.

- Macro Factors: Regulatory news or macroeconomic shifts could override on-chain signals.

While the SOPR dip introduces caution, Bitcoin’s price action remains undeniably strong. For now, the market seems to be betting on a “hold-and-accumulate” strategy—but as always in crypto, vigilance is key.