Bitcoin’s November Struggles: Will Demand Bounce Back or Lead to Accumulation?

As we dive into November, Bitcoin finds itself in a familiar position, having turned red for two consecutive months. This recent downturn raises questions about the future trajectory of the leading cryptocurrency. According to insights from Bitfinex, Bitcoin is at a crossroads, facing two potential paths: a resurgence in demand or a prolonged accumulation phase.

Understanding Bitcoin’s Current Position

Bitcoin’s performance over the past couple of months has deviated from the expectations of many investors and analysts. The cryptocurrency has historically shown resilience, often bouncing back after dips. However, the scenario this time seems to be more complex. With two months of negative performance, Bitcoin’s price action indicates a potential shift in market sentiment.

Possible Pathways: Demand Resurgence vs. Accumulation

As Bitcoin navigates this challenging period, the market is left pondering its next move. Let’s explore the two scenarios that could unfold:

- Resurgence in Demand: One optimistic outlook is that demand for Bitcoin could soon surge. Factors such as institutional interest, retail investment, or macroeconomic changes could ignite renewed buying activity. If demand picks up, it could lead to a significant price rebound, providing a much-needed boost to the market.

- Deeper Accumulation Phase: On the flip side, if demand remains sluggish, Bitcoin might enter a deeper accumulation phase. This could mean that prices stagnate as investors wait for clearer signals before making any substantial moves. During this time, accumulation could happen as long-term holders buy in at lower prices, potentially setting the stage for a future rally.

What Should Investors Watch For?

As the market fluctuates, investors should keep a close eye on several key indicators:

- Market Sentiment: Monitoring investor sentiment and behavior can provide insights into potential demand shifts.

- Institutional Investments: The actions of large institutional players can significantly influence market dynamics. Increased participation from institutions often signals confidence in the asset.

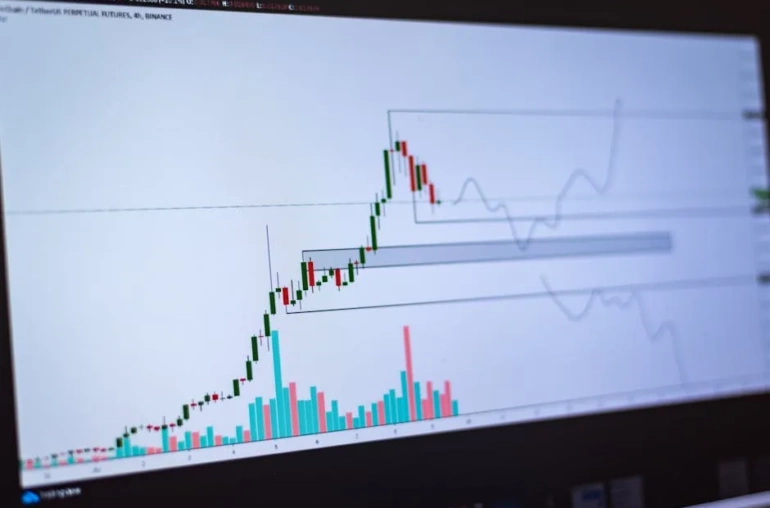

- Technical Analysis: Chart patterns and technical indicators can help identify potential reversal points or ongoing trends in Bitcoin’s price.

Conclusion

As Bitcoin continues to navigate the uncertain waters of November, the potential for either a demand resurgence or a deeper accumulation phase hangs in the balance. Investors must remain vigilant and informed, ready to adapt to the market’s ever-changing landscape. Whether you are a seasoned trader or a newcomer to the cryptocurrency space, understanding these dynamics is crucial as we look ahead.