Bitcoin Surges Toward $125k as Market Sentiment Shifts

In an exciting turn of events for the cryptocurrency market, Bitcoin (BTC) has demonstrated a robust bullish breakout as it flirted with its all-time high over the weekend. This surge in price comes amidst increasing optimism in the financial markets, notably with Citi analysts revising their forecasts for the S&P 500. As the fear and greed index rises, the momentum for Bitcoin seems poised to continue.

Understanding the Current Market Dynamics

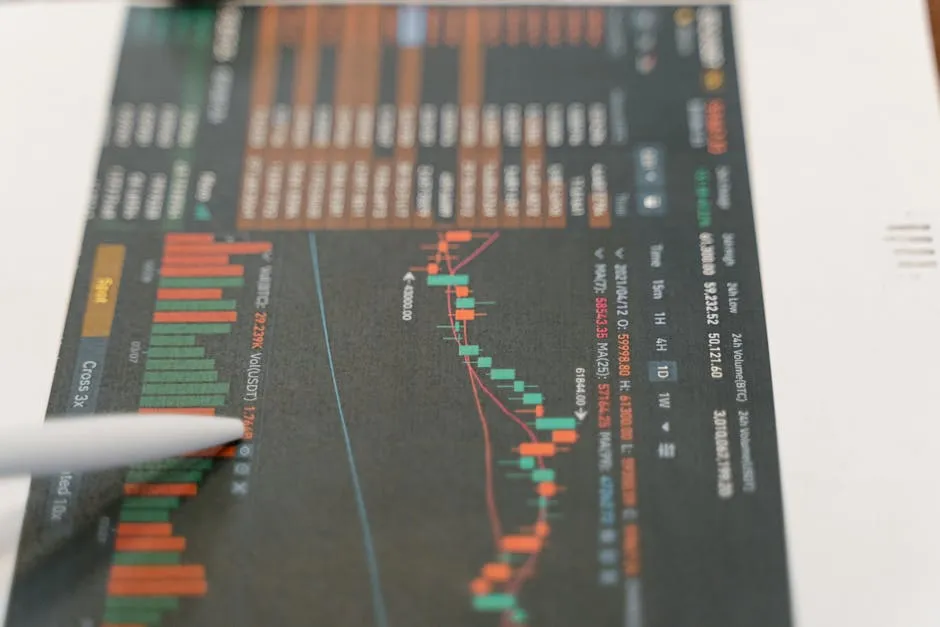

Bitcoin’s recent price movement has captured the attention of investors and analysts alike. Following a strong bullish trend on Sunday that extended into Monday, BTC prices have surged, nearing the crucial psychological level of $125,000. This shift is more than just a price jump; it reflects a broader sentiment change within the market.

The fear and greed index, a popular tool for gauging market sentiment, has shown an uptick in optimism, indicating that investors are becoming more confident. This shift can often lead to increased buying activity, further propelling Bitcoin’s price upward. The index is particularly relevant in times of volatility, as it helps traders make informed decisions based on collective market emotions.

Citi’s Impact on Market Sentiment

Adding to the positive atmosphere, Citi’s recent forecast adjustment for the S&P 500 has sparked renewed interest in equities and, by extension, the cryptocurrency market. Analysts at Citi have enhanced their projections, which can be seen as a vote of confidence in the overall economic recovery. When traditional markets exhibit strength, it often creates a favorable environment for alternative assets like Bitcoin.

What This Means for Investors

For investors and traders, these developments are crucial. The combination of a bullish Bitcoin breakout and heightened market sentiment suggests potential for continued upward momentum. However, volatility is inherent in the cryptocurrency space, and while the outlook may be optimistic, it is essential to remain cautious.

- Stay Informed: Keep an eye on market trends and news that could impact Bitcoin’s price.

- Diversify Investments: Consider a balanced approach by diversifying across different assets.

- Manage Risks: Use risk management strategies to navigate potential fluctuations in price.

Conclusion

As Bitcoin eyes the $125k mark, the interplay of market sentiment and external forecasts will be critical in shaping its trajectory. With the fear and greed index moving towards greed, and Citi’s optimistic outlook on equities, the stage is set for a potentially exciting period in the cryptocurrency market. Investors should remain vigilant and prepare for both opportunities and challenges that may arise in the coming weeks.