Bitcoin’s Rocky Road: Analysts Warn of Potential Drop Below $100K

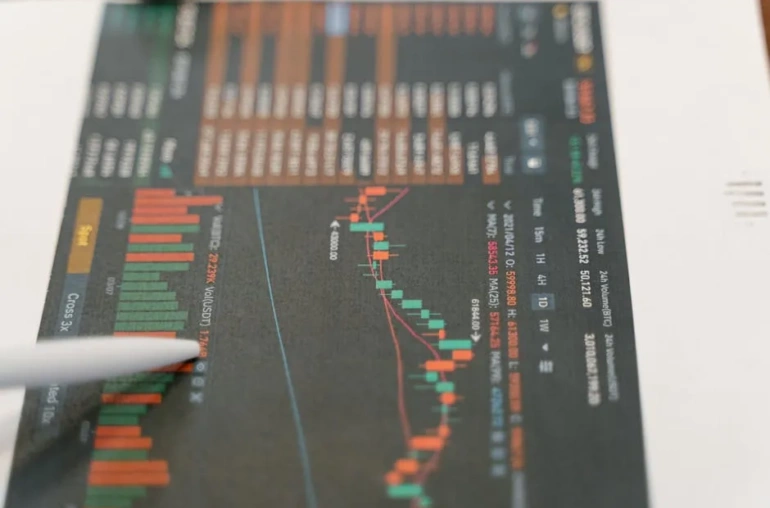

Bitcoin (BTC) is facing renewed pressure as technical indicators suggest a potential retest of the $100,000 support level—or even a dip below it. Market analysts are closely watching the Relative Strength Index (RSI), a key momentum indicator, which appears to be trending toward new lows. According to recent data, the RSI could reach oversold territory within the next week, signaling further downside for the world’s largest cryptocurrency.

Why the RSI Matters for Bitcoin

The RSI is a critical tool for traders, measuring the speed and change of price movements. When the RSI falls below 30, it typically indicates an oversold condition—often a precursor to a price rebound. However, if the RSI continues to decline without a corresponding recovery, it can signal sustained bearish momentum. Currently, Bitcoin’s RSI is trending downward, leading some analysts to predict further losses before any meaningful recovery.

Market Sentiment and Price Targets

Traders are bracing for a possible drop below $100K, a psychological support level that has held strong in recent months. If Bitcoin breaches this threshold, the next key support zones could be around $95K or even lower. Some analysts argue that a brief dip below $100K might present a buying opportunity, while others caution that prolonged weakness could trigger a deeper correction.

Key Factors Influencing Bitcoin’s Movement

- Macroeconomic Conditions: Rising interest rates and inflation concerns continue to weigh on risk assets, including crypto.

- Institutional Activity: Large investors remain cautious, with inflows into Bitcoin ETFs slowing.

- Technical Indicators: Beyond the RSI, other metrics like moving averages and trading volume suggest weakening momentum.

What Traders Should Watch Next

For those monitoring Bitcoin’s trajectory, the next week will be crucial. If the RSI stabilizes or reverses, it could signal a short-term bounce. However, if selling pressure persists, traders may need to adjust their strategies accordingly. Keeping an eye on broader market trends—such as stock market performance and regulatory developments—will also be essential in assessing Bitcoin’s next move.

While volatility is nothing new in crypto, the current setup suggests that caution may be warranted. Whether Bitcoin holds above $100K or breaks lower, the coming days will likely set the tone for the next major trend.