Bitcoin’s Resilience in a Hawkish Market

Bitcoin continues to defy traditional market logic, holding firm above the critical $103,600 support level despite broader economic uncertainty. This key threshold has become a battleground for bulls and bears, with analysts closely watching whether BTC can maintain its footing or succumb to a deeper correction.

Why $103,600 Matters for Bitcoin

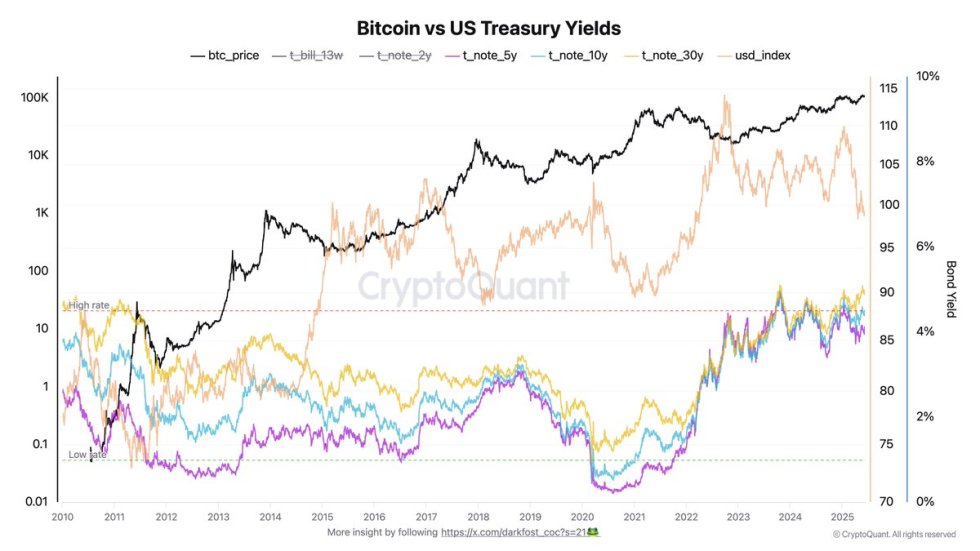

The $103,600 level has emerged as a psychological and technical stronghold throughout this market cycle. A sustained break below this support could trigger cascading liquidations, potentially pushing Bitcoin under $100,000 and sparking a broader crypto market downturn. However, the fact that BTC continues to trade above this level—despite hawkish central bank policies and macroeconomic headwinds—signals remarkable strength.

Risk Appetite Grows Against the Odds

Traditionally, assets like Bitcoin struggle when central banks signal tighter monetary policy. Yet, BTC’s resilience suggests that institutional and retail investors are increasingly viewing it as a hedge against macroeconomic instability. Key factors driving this sentiment include:

- Institutional inflows: Major players continue accumulating Bitcoin despite market volatility.

- ETF momentum: Spot Bitcoin ETFs are seeing consistent demand, providing underlying support.

- Macro uncertainty: Geopolitical tensions and inflation fears are pushing investors toward hard assets.

What’s Next for Bitcoin?

If Bitcoin holds above $103,600, analysts suggest a retest of all-time highs could be in play. However, failure to maintain this level may lead to a swift drop toward $95,000–$98,000 before finding stronger support. Traders should watch for:

- On-chain activity: Whale movements and exchange flows will indicate sentiment shifts.

- Macro developments: Fed policy changes or geopolitical escalations could sway the market.

- Technical indicators: The RSI and moving averages will help gauge short-term momentum.

For now, Bitcoin’s ability to break macro rules highlights its evolving role in global finance—one that may increasingly diverge from traditional risk assets.