Bitcoin Faces Mounting Pressure as Key Players Reduce Holdings

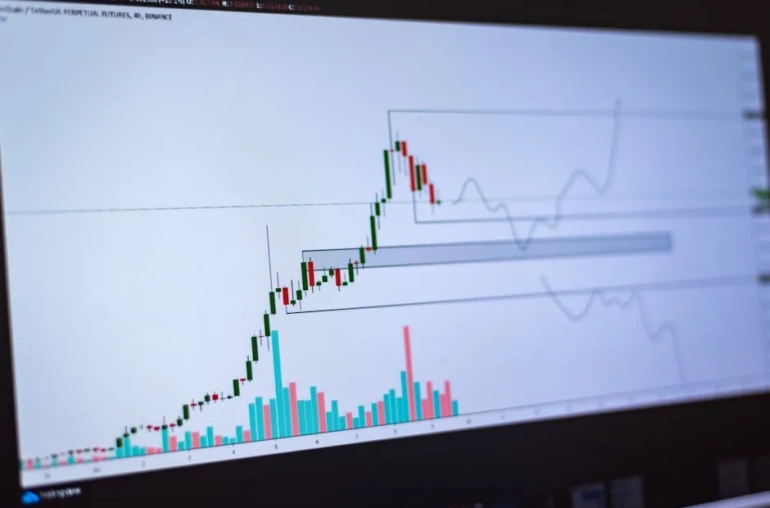

The recent volatility in the cryptocurrency market has analysts on high alert, with warnings that Bitcoin’s price could be poised for a deeper correction. After a period of consolidation, fears are growing that the flagship digital asset may test, or even break below, the $64,000 support level. This potential downturn is being attributed to a concerning trend dubbed “campaign selling” by market veterans.

What is “Campaign Selling” and Why Does It Matter?

The term “campaign selling” refers to a coordinated or sustained period of selling pressure from major market participants. Unlike a single large sell-off, it suggests a strategic, prolonged effort to reduce exposure, which can steadily erode price support over time. This type of activity is particularly worrisome during an already fragile market phase, as it can amplify downward momentum and trigger wider panic selling.

Currently, two significant sources are contributing to this supply pressure: Bitcoin miners and U.S. spot Bitcoin Exchange-Traded Funds (ETFs).

Miners and ETFs: A Dual Threat to Price Stability

Bitcoin miners, who secure the network and are rewarded with new BTC, are often forced to sell a portion of their holdings to cover operational costs like electricity and hardware. During periods of price stress or when profitability tightens, miners may increase their selling activity to maintain cash flow. This adds a consistent stream of new supply to the market.

Perhaps more impactful in the current climate is the activity of the U.S. spot Bitcoin ETFs. After a historic launch and massive inflows earlier in the year, these funds have recently shown signs of slowing demand or even net outflows. When these ETFs are not buying enough new Bitcoin to offset daily miner issuance and other selling, they effectively become a net neutral or negative force. This removes a key pillar of buy-side support that the market has relied on for months.

Navigating a Fragile Market Trend

The combination of miner selling and reduced ETF buying creates a challenging environment. It suggests that the natural market balance is shifting, with supply beginning to outpace demand. For traders and investors, this underscores the importance of key technical levels. The $64,000 zone is now seen as a critical battleground; a decisive break below it could open the door to a steeper decline as stop-loss orders are triggered and sentiment sours further.

While the long-term narrative for Bitcoin, driven by institutional adoption and its fixed supply, remains intact for many, short-term headwinds are clearly building. Market participants are advised to monitor ETF flow data and broader market sentiment closely, as these factors will likely dictate Bitcoin’s direction in the coming weeks. As always in crypto, volatility is the only constant, and navigating it requires both caution and a clear strategy.