Asia’s Stock Exchanges Stand Firm Against Crypto Treasury Companies

In a significant move within the financial landscape, leading stock exchanges in Asia, particularly in Hong Kong, India, and Australia, are tightening their regulations concerning companies that aim to accumulate large reserves of cryptocurrency, often referred to as crypto treasuries. This stance reflects growing concerns about the potential misuse of these companies as mere shell entities.

What Are Crypto Treasuries?

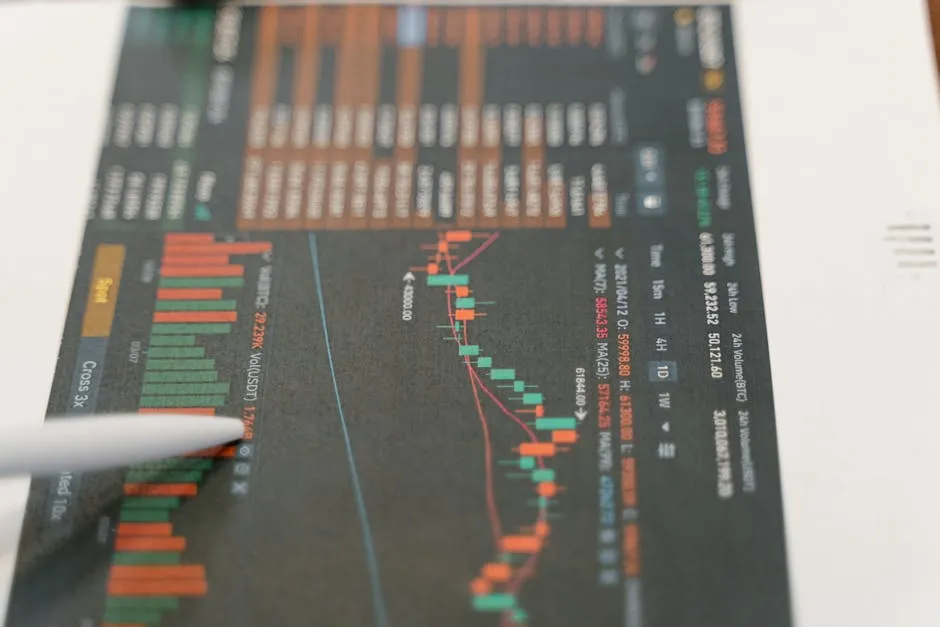

Crypto treasuries refer to companies or entities that hold a substantial portion of their assets in cryptocurrencies. While this practice has gained traction in recent years, particularly among tech firms and startups, it raises important questions about transparency and accountability. The allure of accumulating digital assets can sometimes entice companies to operate without a solid business foundation, leading regulators to scrutinize their operations closely.

Regulatory Pushback

The pushback from Asian stock exchanges is primarily driven by concerns that these crypto treasury companies may not be using their holdings for legitimate business purposes. Instead, they could be functioning as shell companies, which are often associated with money laundering and tax evasion. By rejecting applications from firms seeking to establish significant crypto holdings, exchanges aim to maintain the integrity and reputation of their markets.

Market Impact

This regulatory stance could significantly affect the crypto landscape in Asia. Companies that had planned to leverage their crypto treasuries as a means of attracting investors may need to reevaluate their strategies. The tightening of regulations could lead to a shift in how businesses approach cryptocurrency, potentially favoring those that prioritize transparency and compliance.

Looking Ahead

As the cryptocurrency market continues to evolve, the actions of these Asian exchanges serve as a reminder of the ongoing balancing act between innovation and regulation. While the potential for cryptocurrencies to revolutionize finance is immense, the need for robust regulatory frameworks has never been more critical. Stakeholders in the crypto space will need to navigate these new challenges carefully, ensuring they operate within the bounds of the law while still pursuing opportunities in this dynamic market.

In conclusion, as Asia’s stock exchanges take a firm stand against crypto treasury companies, the implications for the broader cryptocurrency market are profound. The emphasis on compliance and legitimacy will likely shape the future of crypto investments, pushing companies to adopt more responsible practices as they move forward in this ever-changing landscape.